10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on March 21, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

_________________________

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2024

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ___________ to ___________

Commission file number 001-42302

_________________________

(Exact name of registrant as specified in its charter)

_________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||

(703 ) 748-2005

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o |

Accelerated filer | o |

|||||||||||

x |

Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation of its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant on December 31, 2024, based on the closing price of $25.07 per share of the registrant’s Class A common stock as reported by The New York Stock Exchange on December 31, 2024, was approximately $75,948,000 . The registrant has elected to use December 31, 2024 as the calculation date, which was the last business day of the registrant’s most recently completed fiscal year, because on June 28, 2024 (the last business day of the registrant’s second fiscal quarter), the registrant was a privately-held company.

As of March 20, 2025, the registrant had outstanding 3,119,317 shares of Class A Common Stock, par value $0.01 per share and 3,442,500 shares of the registrant's Class B Common Stock, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

1

TABLE OF CONTENTS

| Page | |||||

Index of Defined Terms and Acronyms |

|||||

Item 1. Business |

|||||

Item 15. Exhibits and Financial Statement Schedules |

|||||

2

INDEX OF DEFINED TERMS AND ACRONYMS

| ACL | Allowance for Credit Losses | |||||||

| AFS | Available for Sale | |||||||

| AI | Artificial Intelligence | |||||||

| ALCO | Asset Liability Investment Committee of the Board of Directors of Chain Bridge Bank, N.A. | |||||||

| AOCI | Accumulated Other Comprehensive Income (Loss) | |||||||

| ASU | Accounting Standards Update | |||||||

| Bank | Chain Bridge Bank, N.A. | |||||||

| BHC | Bank Holding Company | |||||||

| BHC Act | U.S. Bank Holding Company Act of 1956, as amended | |||||||

| Board or Board of Directors | The Board of Directors of Chain Bridge Bancorp, Inc. | |||||||

| bps | Basis points, defined as one hundredth of one percentage point | |||||||

| Bylaws | Our amended and restated bylaws, which have been adopted by our Board |

|||||||

| Call Report | The Federal Financial Institutions Examination Council (“FFIEC”) Consolidated Reports of Condition and Income, which the Bank files with the FFIEC on a quarterly basis |

|||||||

| CECL |

Current Expected Credit Losses (ASU 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments)

|

|||||||

| Chain Bridge, CBNA, the Company, we, us, our | Chain Bridge Bancorp, Inc., and its Subsidiaries | |||||||

| Charter | Our amended and restated certificate of incorporation, which became effective on October 3, 2024. The Charter authorizes the establishment of our Class A common stock and Class B common stock and effected the reclassification of each outstanding share of our common stock into 170 shares of Class B common stock |

|||||||

| Class A common stock | Our Class A common stock, par value $0.01 per share |

|||||||

Class B common stock |

Our Class B common stock, par value $0.01 per share |

|||||||

| Common stock | Our Class A common stock and our Class B common stock |

|||||||

| CRE | Commercial real estate | |||||||

| DGCL | Delaware General Corporation Law | |||||||

| EPS | Earnings per share | |||||||

| EVE | Economic value of equity | |||||||

| FASB | Financial Accounting Standard Board | |||||||

| FDIC | Federal Deposit Insurance Corporation | |||||||

| Federal Reserve | Federal Reserve System, the Board of Governors of the Federal Reserve System, or the Federal Reserve Bank of Richmond, Virginia |

|||||||

| FFIEC | Federal Financial Institutions Examination Council | |||||||

Fitzgerald Family |

Collectively, the lineal descendants of Gerald Francis Fitzgerald, deceased, and Marjorie Gosselin Fitzgerald, their spouses or surviving spouses, children, and grandchildren, and the spouses of their children and grandchildren. These persons include, but are not limited to, Peter Gosselin Fitzgerald, Gerald Francis Fitzgerald, Jr., James Gosselin Fitzgerald, Thomas Gosselin Fitzgerald, Julie Fitzgerald Schauer, Thomas Gosselin Fitzgerald, Jr., Andrew James Fitzgerald, and Lauren Fitzgerald Peterson |

|||||||

| GAAP | Generally Accepted Accounting Principles | |||||||

| HTM | Held to Maturity | |||||||

ICS®

|

IntraFi Cash Service®

|

|||||||

| IPO | Initial public offering | |||||||

| N/A | Not Applicable | |||||||

3

| NM | Not Meaningful (Comparisons of positive and negative values or to zero values are considered not meaningful) | |||||||

| OCC | Office of the Comptroller of the Currency | |||||||

| Old common stock | Our common stock, par value $1.00 per share, prior to the Reclassification | |||||||

| Political organizations | Campaign committees; party committees; separate segregated funds (including trade association political action committees (“PACs”) and corporate PACs); non-connected committees (including independent expenditure-only committees (“Super PACs”), committees maintaining separate accounts for direct contributions and independent expenditures (“Hybrid PACs”), and committees other than authorized campaign committees, or those affiliated with such committees that are maintained or controlled by a candidate or federal officeholder (collectively, “Leadership PACs”)); and other tax-exempt organizations under Section 527 of the Internal Revenue Code |

|||||||

| Pre-IPO investors | The holders of our shares of old common stock immediately prior to the Reclassification | |||||||

| Reclassification | The reclassification of each outstanding share of our old common stock into 170 shares of Class B common stock |

|||||||

| Return on average risk-weighted assets | Return on average risk-weighted assets is calculated as net income divided by average risk-weighted assets. Average risk-weighted assets are calculated using the last five quarter ends. | |||||||

| RWA | Risk-weighted assets | |||||||

| SEC | United States Securities and Exchange Commission | |||||||

| Tier 1 capital ratio | Tier 1 capital, which includes Common Equity Tier 1 capital plus non-cumulative perpetual preferred equity that qualifies as additional tier 1 capital, divided by total risk-weighted assets as defined under the U.S. Basel III Standardized approach | |||||||

| Tier 1 leverage ratio | Tier 1 capital, which includes Common Equity Tier 1 capital plus non-cumulative perpetual preferred equity that qualifies as additional tier 1 capital, divided by quarterly adjusted average assets as defined under the U.S. Basel III Standardized approach | |||||||

| Total capital ratio | Total capital, which includes Common Equity Tier 1 capital, tier 1 capital, and allowance for credit losses and qualifying subordinated debt that qualifies as tier 2 capital, divided by total risk-weighted assets as defined under the U.S. Basel III Standardized approach | |||||||

| Transaction accounts | As defined in the instructions for the Call Report | |||||||

4

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Unless we state otherwise or the context otherwise requires, “we,” “us,” “our,” “Chain Bridge,” “our Company,” and “the Company,” refer to Chain Bridge Bancorp, Inc., a Delaware corporation, and its consolidated subsidiary, Chain Bridge Bank, National Association. The “Bank” and “Chain Bridge Bank, N.A” refer to Chain Bridge Bank, National Association, a nationally chartered bank.

This Annual Report on Form 10-K contains forward-looking statements, which involve risks and uncertainties. You should not place undue reliance on forward-looking statements because they are subject to numerous uncertainties and factors relating to our operations and business, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These forward-looking statements are generally identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and, in each case, their negative or other variations or comparable terminology and expressions. All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements regarding our strategies, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. The forward-looking statements are contained in this Annual Report on Form 10-K include, but are not limited to, statements relating to:

•Changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, including the effects of United States federal government spending;

•The level of, or changes in the level of, interest rates and inflation, including the effects on our net interest income, noninterest income, and the market value of our investment and loan portfolios;

•The level and composition of our deposits, including our ability to attract and retain, and the seasonality of, client deposits, including those in the IntraFi Cash Service (“ICS®”) network, as well as the amount and timing of deposit inflows and outflows into early 2025;

•Our political organization clients’ fundraising and disbursement activities;

•The level and composition of our loan portfolio, including our ability to maintain the credit quality of our loan portfolio;

•Current and future business, economic and market conditions in the United States generally or in the Washington, D.C. metropolitan area in particular;

•The effects of disruptions or instability in the financial system, including as a result of the failure of a financial institution or other participants in it, or geopolitical instability, including war, terrorist attacks, pandemics and man-made and natural disasters;

•The impact of, and changes, in applicable laws, regulations, regulatory expectations and accounting standards and policies;

•Our likelihood of success in, and the impact of, legal, regulatory or other actions, investigations or proceedings related to our business;

•Adverse publicity or reputational harm to us, our senior officers, directors, employees or clients;

•Our ability to effectively execute our growth plans or other initiatives;

•Changes in demand for our products and services;

•Our levels of, and access to, sources of liquidity and capital;

•The ability to attract and retain essential personnel or changes in our essential personnel;

•Our ability to effectively compete with banks, non-bank financial institutions, and financial technology firms and the effects of competition in the financial services industry on our business;

•The effectiveness of our risk management and internal disclosure controls and procedures;

•Any failure or interruption of our information and technology systems, including any components provided by a third party;

•Our ability to identify and address cybersecurity threats and breaches;

5

•Our ability to keep pace with technological changes;

•Our ability to receive dividends from the Bank and satisfy our obligations as they become due;

•The one-time and incremental costs of operating as a public company;

•Our ability to meet our obligations as a public company, including our obligation under Section 404 of Sarbanes-Oxley; and

•The effect of our dual-class structure and the concentrated ownership of our Class B common stock, including beneficial ownership of our shares by the lineal descendants of Gerald Francis Fitzgerald, deceased, and Marjorie Gosselin Fitzgerald, their spouses or surviving spouses, children, and grandchildren, and the spouses of their children and grandchildren (the “Fitzgerald Family”).

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors”. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K. And while we believe such information provides a reasonable basis for such statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements. Past performance is not a guarantee of future results or returns and no representation or warranty is made regarding future performance.

6

PART I

ITEM 1. BUSINESS

Our Company

Chain Bridge Bancorp, Inc. is a Delaware-chartered bank holding company and the parent of its wholly-owned subsidiary, Chain Bridge Bank, N.A., a nationally chartered commercial bank with fiduciary powers granted by the OCC. The Company was incorporated on May 26, 2006, and the Bank opened on August 6, 2007. The Company conducts substantially all of its operations through the Bank and has no other subsidiaries.

We offer a range of commercial and personal banking services, including deposits, treasury management, payments, loans, commercial lending, residential mortgage financing, consumer loans, trusts and estate administration, wealth management, and asset custody.

Our mission is to deliver exceptional banking and trust services nationwide, blending financial strength, personalized service, and advanced technology to offer tailored solutions to businesses, non-profit organizations, political organizations, individuals, and families. Our vision is to grow responsibly by adapting our personalized service and advanced technology solutions to our clients’ evolving needs while emphasizing liquidity, asset quality, and financial strength. We aim to be recognized for our “Strength, Service, Solutions: Your Bridge to Better Banking Nationwide.”

As of December 31, 2024, we held total assets of $1.4 billion, including $410.7 million in cash and cash equivalents, of which $406.7 million were interest-bearing reserves held at the Federal Reserve. Our portfolio included $659.0 million in securities, with $321.0 million or 48.7% of that in U.S. Treasury securities. Net loans held for investment, after accounting for deferred fees and costs and allowances, totaled $308.8 million. Our total deposits stood at $1.2 billion, with stockholders’ equity at $144.2 million. Approximately 93.3% of these deposits were held in transaction accounts (as such term is defined in the instructions for the Call Report, which the Bank files with the FFIEC on a quarterly basis). Our loan-to-deposit ratio was 25.1%.

Additionally, we hold excess deposits sold one-way to other participating banks through the IntraFi Cash Service® (ICS®). For our clients that opt into the ICS® network, this service allows us to place their deposits in increments up to the FDIC insurance limits at other banks within the ICS® network. In exchange, we may elect to either receive reciprocal deposits from other banks within the ICS® network or place the deposits at other banks as “One-Way Sell®” deposits and receive a deposit placement fee. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Financial Condition — Deposits” for more information on ICS® deposits.

Initial Public Offering

On October 4, 2024, the Company’s Class A Common Stock began trading on the NYSE under the symbol “CBNA”. We issued and sold an aggregate of 1,992,897 shares of our Class A Common Stock including 142,897 shares of Class A Common Stock sold pursuant to the underwriters’ partial exercise of their option to purchase additional shares, in our initial public offering, at a public offering price of $22.00 per share for aggregate net proceeds of $36.5 million after deducting underwriting discounts and offering expenses. The initial closing of our initial public offering occurred on October 7, 2024, and the closing for the shares issued pursuant to the underwriters’ option occurred on November 1, 2024. On October 10, 2024, the Company used a portion of the net proceeds to fully repay $10.0 million in short-term borrowings. The IPO had a positive impact on our capital position, and contributed to Tier 1 leverage, Tier 1 risk-based, and total risk-based capital ratios of 11.48%, 38.12% and 39.30%, respectively as of December 31, 2024. The Company intends to use the remainder of net proceeds for general corporate purposes, which may include supporting continued organic deposit growth and funding potential strategic expansion.

Reclassification

In connection with the IPO, on October 3, 2024, the Company filed an Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, which established two new classes of common stock, the Class A Common Stock and Class B Common Stock, and reclassified and converted each outstanding share of the Company’s existing common stock, par value $1.00 per share, into 170 shares of Class B Common Stock. The Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware also changed the number of authorized shares of Preferred Stock from 100,000 to 10,000,000.

Our Regulatory Framework and Banking Philosophy

Chain Bridge Bank, N.A. operates under a national charter with full fiduciary powers granted by the OCC. Our national charter allows us to offer banking services across state lines without additional state banking licenses. The OCC

7

serves as our primary federal regulator, overseeing our operations and compliance with applicable federal banking laws and regulations. Our national bank fiduciary powers enable us to offer trust services broadly.

Our operations under this regulatory framework reflect a banking philosophy that emphasizes liquidity, asset quality, and financial strength. This approach guides our asset allocation strategy, risk management practices, and deposit gathering efforts.

Balance Sheet Strategy and Composition

Our balance sheet composition reflects our banking philosophy of emphasizing liquidity, asset quality, and financial strength. We aim to allocate a high proportion of our assets to interest-bearing reserves at the Federal Reserve and to securities that we believe qualify as investment grade.

Our asset allocation strategy is designed to balance liquidity maintenance with income generation. We prioritize investments in securities that we believe qualify as investment grade, with a significant portion allocated to U.S. Treasury securities. This approach reflects our focus on managing credit risk while maintaining liquidity. We strive to maintain a low proportion of assets that we consider to be illiquid.

Lending Approach and Credit Risk Management

Our lending policies are designed to manage credit risk. Our approach has historically resulted in what we consider to be low levels of non-performing loans and loan charge-offs. As of December 31, 2024, we have reported no non-performing assets since June 30, 2012. The Company has not reported any loan charge-offs since the third quarter of 2017 and has incurred a cumulative net loan charge-offs of $265 thousand since inception.

Deposit Composition and Strategy

We aim to attract transaction account deposits, particularly from commercial clients. Our investment approach for these funds is intended to be conservative, based on our interpretation of prudent banking practices and current regulatory guidelines.

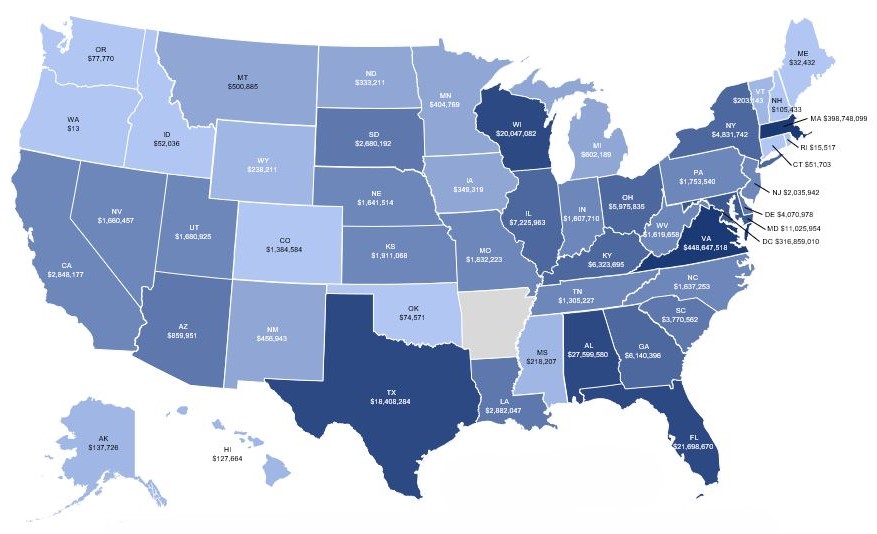

As of December 31, 2024, we served deposit clients in 49 states, the District of Columbia, and Puerto Rico. The following chart shows the distribution of the Bank’s total deposits and One-Way Sell® deposits by dollar amount across the United States as of December 31, 2024:

($ in thousands)

8

To support our strategy of attracting commercial transaction account deposits, we emphasize services designed to attract commercial clients who manage high transaction volumes. These services include digital onboarding solutions, image cash letter (“ICL”) processing and treasury management offerings that accommodate multiple users with customizable approval hierarchies. This focus aligns with our goal of attracting and retaining commercial clients with complex transactional needs.

At December 31, 2024, 93.3% of our total deposits were held in transaction accounts. For the year ended December 31, 2024, our cost of funds was 0.31%.

The composition of our deposit base and the associated cost of funds are consistent with our focus on transaction accounts. Our experience suggests that clients with these types of accounts may interact more frequently with our banking services and relationship officers compared to those with other account types. This interaction may be associated with increased use of our services, which aligns with our approach to client relationships.

Operational Model and Technology Focus

Our model emphasizes attentive, relationship-based service enhanced by technology solutions. This strategy allows the Bank to serve clients efficiently across a wide geographic area while maintaining lower overhead costs compared to some branch-based banking models.

We believe our technology-driven approach allows us to deliver banking services efficiently, with a focus on meeting the needs of commercial clients who manage high transaction volumes and have complex organizational structures. Our treasury management system is designed to handle substantial transaction volumes and accommodate complex organizational structures often found in larger commercial entities. The system features multi-user access with customizable approval hierarchies, allowing clients to tailor the system to their specific operational needs. It also offers integration capabilities with popular accounting software and includes mobile batch check deposit functionality.

Our technology infrastructure is designed to process electronic transactions efficiently, including support for industry-standard formats commonly used for large-scale deposits. This infrastructure is intended to facilitate the handling of significant transaction volumes for our more active commercial clients, including political organizations, in a timely manner. While the technologies we employ are generally available in the banking industry, we believe our approach to implementing and customizing these solutions for specific client needs may distinguish us from many institutions of comparable size. We have developed capabilities in adapting our systems to address the particular requirements of clients with high transaction volumes. This allows us to offer banking solutions that we believe are comparable to those typically associated with larger financial institutions. As payment technologies continue to evolve, we strive to maintain our technological capabilities and adapt our services to meet the changing needs of our diverse commercial client base.

Our business model operates without a traditional branch network. As of December 31, 2024, we provide in-person banking services exclusively from our headquarters and do not operate additional physical banking locations. Based on our experience, we believe many of our clients prefer to conduct their banking transactions electronically through our digital platform, which offers services such as mobile deposit, ACH, wire transfers, and bill payment. This approach allows clients to manage their banking needs from anywhere, reducing the need to visit a physical branch.

We believe our technology-driven approach enables us to provide attentive, personalized service, despite our limited physical footprint. Our relationship officers are required to be directly accessible via phone, email, and video conferencing, which is intended to ensure that we meet the needs of our clients, particularly modern businesses. This service delivery model offers broad geographic reach and the potential for a competitive advantage by combining attentive personal service with the efficiency and convenience of remote access.

By operating without a branch network, we can direct resources toward enhancing our technology infrastructure and expanding our digital services. This approach is intended to provide our clients with secure, efficient, and convenient banking solutions. However, our branch-less business model may limit our ability to expand our retail lending and deposit businesses beyond the Washington, D.C. metropolitan area, where we have a more concentrated presence.

Serving Political Organizations

We focus on clients and business segments where our experience may offer advantages, such as services for political organizations, tailored business, and residential lending and trust and wealth management. Our approach generally favors developing capabilities in less saturated sectors and avoiding highly competitive markets, like commercial real estate or mass-market consumer banking. We have historically grown organically and many of our new business opportunities have come through word-of-mouth referrals. We believe our client-focused approach has contributed to maintaining strong relationships.

9

We estimate that there are points in time when at least a majority of our deposit balances are sourced from political organizations. This estimate is subject to data limitations and identifying a client as a political organization sometimes requires judgment, and the actual number of our deposits represented by political organizations may differ from this estimate. See “Risk Factors — Operational Risks — Our reliance on estimates and risk management activities may not always prevent or mitigate risks effectively, leading to potential differences between actual results and our forecasts.”

We have experience providing deposit services to several different types of political organizations, including:

•Campaign committees

•Party committees (national, state, and local);

•Corporate and trade association political action committees (“PACs”);

•Super PACs and Hybrid PACs;

•Non-committee 527 organizations;

•Leadership PACs;

•Joint fundraising committees; and

•Presidential inaugural committees.

In addition to political organizations, we also provide deposit accounts to a variety of businesses that support the campaigns and elections industry. These businesses include vendors involved in advertising, television advertisement buying, digital marketing, public opinion polling, opposition research firms, general consulting, fundraising, and services related to treasury, legal, and compliance matters.

Seasonality

Certain aspects of our deposits fluctuate seasonally. Most of this seasonality comes from commercial depositors, primarily political organizations and their vendors that generate and spend funds around federal election cycles. Federal elections in the United States occur every two years in the fourth quarter, on the first Tuesday after the first Monday in November. Primary elections for federal offices, determined by the state and political parties, typically occur in the first, second, or third quarter of the year. Historically, our total deposits have gradually increased in quarters leading up to a federal election, followed by a decline around the election. Deposit growth tends to be stronger leading up to presidential elections, which occur every four years, compared to biennial midterm elections.

Consistent with historical trends, we experienced deposit inflows from political organizations preceding the November 2024 federal election, followed by deposit outflows in the months surrounding the election, reflecting seasonal patterns associated with the election cycle. Election outcomes can also influence the timing and magnitude of deposit movements, including post-election inflows driven by new fundraising or account activities. For further details regarding these seasonal fluctuations and their impact on our financial condition, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Certain types of accounts, such as political party committee accounts, maintain funds throughout the election cycle. Other types of accounts, such as campaign committee accounts, are often established for a single campaign cycle and exhibit greater seasonality. In order to mitigate seasonality risk, we aim to maintain a relatively high level of cash reserve deposits at the Federal Reserve.

Federal election cycles also impact revenue-generating activities, such as wire transfers, payments, check processing, debit card usage, deposit placement through ICS®, and treasury management services, which also increase during this period until the end of the election cycle. Additionally, deposits from trade associations may exhibit seasonality. These associations typically bill their members annually for dues and spend the funds down over the course of the year.

Competition

The banking industry is highly competitive. We compete for loans, deposits, capital and fiduciary services with other banks and other kinds of financial institutions and enterprises, such as securities firms, insurance companies, savings and loan associations, credit unions, mortgage brokers, fintechs, and private lenders, many of which have substantially greater resources or are subject to less stringent regulations. We primarily compete for commercial deposit accounts with the country’s largest banks, which have national reach, and regional banks, some of which also have national reach and advanced technology and treasury management platforms for commercial clients. We also compete with other state, national and international financial institutions located in our market areas, as well as savings associations, savings banks and credit unions for loans and retail deposits. Competition among providers of financial products and services continues to increase, with consumers having the opportunity to select from a growing variety of traditional and nontraditional

10

alternatives, including fintech companies, which have grown significantly in recent years. The ability of non-bank financial institutions to provide services previously limited to commercial banks has intensified competition. See “Risk Factors — Other Risks Related to Our Business — There is no assurance that the Bank will be able to compete successfully with others for its business.”

Our Principal Products, Services and Markets

We offer a range of banking and trust services, including deposits, treasury management, payments, commercial lending, residential loans, mortgage financing, consumer loans, trust and estate administration, and wealth management. While our deposits come from across the United States, the majority of our loans and trust services are concentrated in the Washington, D.C. metropolitan area.

Deposit Services

As of December 31, 2024, transaction account deposit balances made up 93.3% of our total deposits. We provide a variety of commercial and personal deposit services to commercial and individual clients.

Commercial Deposit Services. We offer a suite of deposit accounts designed to meet the needs of businesses:

•Business Checking Accounts: These accounts are designed for startups, sole proprietors, and organizations with limited check-writing and deposit activity, featuring online and mobile banking capabilities.

•Commercial Analysis Checking: These accounts are designed for businesses with high transaction volumes and substantial balances, offering an earnings credit in lieu of interest to offset item processing and service charges.

•Commercial Money Market Accounts: These accounts provide competitive interest rates that increase with higher deposit balances, which is an attractive option for clients managing excess cash reserves.

Personal Banking Services. For individual clients, we offer a variety of checking and savings accounts. These accounts offer online and mobile banking, debit card controls, electronic statements and digital wallet capabilities.

We provide deposit services electronically, which allows us to avoid the costs associated with maintaining a traditional branch network, allowing us to invest more in people and technology and provide our deposit services to clients nationwide. We are also a member of the IntraFi® network of institutions, which allows our deposit clients to enroll in the ICS® program to achieve full FDIC insurance. For a discussion of the ICS® program, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” As of December 31, 2024, we held deposits from clients across 49 states, the District of Columbia, and Puerto Rico, with approximately 23.62% of total deposits and One-Way Sell® deposits from the District of Columbia and approximately 33.44% from Virginia.

We have experience in providing deposit services to political organizations. A substantial portion of our deposit business is derived from federal and, to a lesser extent, state political organizations. We have developed a familiarity with the particular banking needs of these entities, many of which are highly regulated under federal or state law, and the compliance professionals who serve them. Our experience in processing transactions for these organizations allows us to offer services designed to meet the needs of our clients in this sector. For example, we serve our deposit clients through experienced relationship officers and seek to offer personal service and tailored solutions for account management, image cash letters, remote deposit capture, payment processing, and treasury management.

Lending

We provide lending services to consumers and commercial borrowers primarily located in the Washington, D.C. metropolitan area. As of December 31, 2024, our loan portfolio consisted of 67.2% in residential real estate loans, 17.1% in commercial real estate loans, 8.9% in commercial loans, and 6.8% in consumer loans, and approximately 83.4% of our loans were to borrowers located in the Washington, D.C. metropolitan area.

Consumer Lending. Our consumer lending primarily consists of residential mortgage financing, with a primary focus on adjustable rate mortgages. Long-term fixed-rate mortgages exceeding fifteen years are generally not retained on our balance sheet. We specialize in non-conforming jumbo mortgages designed for individuals with sophisticated financial profiles and diverse income streams, as well as construction loans for building or renovating a primary residence. As of December 31, 2024, the Bank held 55 non-conforming single-family residential jumbo mortgage loans with an aggregate balance of $98.8 million, representing 46.88% of the Bank’s total single-family residential mortgage portfolio. We also provide co-op financing, a service typically not offered by mass retail lenders.

A portion of our residential mortgage borrowers also maintain consumer deposit accounts with us. We believe this overlap is an important aspect of our strategy to deepen client relationships by offering a broad range of banking services. For certain residential mortgage clients, the ability to access both lending and deposit services within our institution may

11

enhance their overall banking experience and support the development of long-term relationships. Our ability to serve as both a lender and a depository institution for our residential mortgage clients is a component of our service offering.

Commercial Lending. We provide commercial real estate loans and commercial loans to businesses primarily located in the Washington, D.C. area. We also provide commercial real estate loans secured by income-producing properties or owner-occupied properties. We also provide commercial loans to finance a range of business needs, including expansion, equipment purchases and working capital. In the fourth quarter of 2023, we launched our own branded business credit card program, offering both secured and unsecured credit lines, helping us reduce our reliance on third-party product providers. Our secured business credit card provides businesses with a credit line backed by collateral. Our unsecured business credit card offers a line of credit without collateral, suitable for established businesses with strong credit histories. This initiative was designed to meet the needs of our commercial clients. As of December 31, 2024, the outstanding balance on our business credit cards was immaterial.

Many of our commercial borrowers maintain deposit accounts with us as part of their loan agreements, which supports our strategy of offering integrated financial services. However, our depositors and our borrowers are typically distinct client groups. Large depositors generally use their available cash to avoid incurring significant loan balances, while large borrowers tend to have minimal deposits as they focus on repaying their loans.

The deposit accounts maintained by our commercial borrowers tend to be relatively small and transactional in nature, and we believe the loss of these deposits would not materially affect our financial condition. As such, while there may be limited overlap between loan clients and depositors, we do not consider this overlap to be a significant risk to the Bank’s operations or liquidity.

We actively monitor these relationships as part of our broader risk management efforts, but we believe that any overlap in deposit and loan clients is not material and does not pose a material risk to our business.

FEC-Compliant Lending to Political Organizations

Our lending practices for political organizations are designed to comply with the regulations set forth by the FEC. These regulations require that loans to political committees be made on commercially reasonable terms and be secured by collateral owned by the borrower or the political committee itself. These requirements are intended to ensure that loans are legitimate commercial transactions and not improperly structured as contributions to political campaigns.

We occasionally extend loans to candidate committees, though such committees do not frequently borrow from us. When loans are made to candidate committees, they are structured in accordance with FEC regulations, including requiring appropriate collateral to secure the loan and mitigate repayment risks.

In addition to loans, we offer secured credit cards to a range of political committees, including authorized committees, PACs, and party committees. These credit cards are typically secured by cash deposits, which helps ensure compliance with applicable FEC regulations.

Lines of credit may be extended to national party committees. These lines of credit are generally secured by collateral, such as contributor lists, which we arrange to have appraised by independent third-party appraisers to assess whether the value of the collateral is sufficient to cover the loan amounts. In accordance with FEC requirements, the terms offered for loans to political committees are intended to align with those available to non-political clients, with the goal of ensuring that these transactions are conducted on a commercially reasonable basis.

We also provide letters of credit to our commercial borrowers, including political organizations, to assist them in meeting the security deposit requirements for their office leases. These letters of credit are issued in accordance with our standard lending practices and are typically supported by collateral or other security arrangements consistent with commercial lending norms.

Trust and Wealth Management Services

Our Trust & Wealth Department commenced operations in the third quarter of 2020 after the approval by the OCC of the Bank’s application for full fiduciary powers. Our trust offerings serve individuals, families, charitable organizations, and businesses. Our Trust & Wealth Department offers a range of fiduciary services, including:

•Serving as trustee, investment manager with sole or joint discretion, executor, administrator, registrar of stocks and bonds, and guardian of estates, management of hard-to-value assets such as real estate, closely held businesses, mineral interests, loans and notes, life insurance, and tangible assets like collectibles, and offering specialized trusts such as special needs trusts, settlement protection trusts, land trusts, and charitable trusts.

•Providing wealth management services, including investment management, financial planning, and personalized strategies integrating investments, cash flow, risk management, and estate planning.

12

•Providing custodial services for both publicly traded and unique and hard-to-value assets to individual investors, trust administrators, nonprofits, and retirement account holders.

In 2023, we initiated a pilot of the Black Diamond Wealth Platform, which is designed to enhance client experiences by providing a dashboard that integrates information from our trust accounting system and financial planning software. The platform allows clients to access more detailed information about their financial status, such as asset allocation, account activity, portfolio performance, and projected income, for both individual accounts and consolidated portfolios. We have completed the initial rollout of the platform to our current clients, but work continues as we incorporate additional features.

Although we primarily provide trust and wealth management services to clients in the Washington, D.C. area, our national banking charter and fiduciary powers enable us to provide these services in the majority of states, differentiating us from many other financial institutions. However, some states have physical presence requirements for trust services, and the interplay between federal and state regulations in this area continues to evolve. We consider these factors as we serve clients across jurisdictions.

Our Trust & Wealth Department is subject to the supervision, examination and regulation of the OCC, which requires us to adhere to federal regulations and industry standards pertinent to fiduciary activities. In addition, our fiduciary activities are governed by the National Bank Act, which creates a statutory lien for funds our clients hold in trust and custodial accounts, and prohibits the use of trust and custodial assets for the Bank’s business activities.

Risk Management

We believe that effective risk management and control processes are essential to the Bank’s safety and soundness, our ability to address the challenges that we face and, ultimately, our long-term corporate success. Generally speaking, risk is the potential that events, expected or unanticipated, may have an adverse effect on our current or projected earnings or financial condition or on our franchise value. Consistent with the risk assessment system used by the OCC, we evaluate and monitor the following categories of risk:

•Credit risk. Credit risk refers to the risk arising from an obligor’s failure to perform as agreed. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition—Credit Policies and Procedures” for a discussion of how we seek to manage credit risk.

•Interest rate risk. Interest rate risk refers to the risk arising from movements in interest rates. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Interest Rate Sensitivity and Market Risk” for a discussion of how we seek to manage interest rate risk.

•Liquidity risk. Liquidity risk refers to the risk arising from our inability to meet our obligations when they come due. Liquidity risk also includes the risk of being unable to access funding sources or manage funding levels, or failing to recognize or address changes in market conditions that affect our ability to liquidate assets quickly and with minimal loss in value. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Management—Liquidity Risk Management” for a discussion of how we seek to manage liquidity risk.

•Price risk. Price risk refers to the risk arising from changes in the value of assets or liabilities accounted for on a mark-to-market basis. To manage price risk, we monitor our investment portfolio and generally attempt to avoid activities that would incur additional price risk, such as market-making, dealing, trading, or otherwise taking positions in futures, foreign exchange, equities, commodities, or other speculative markets.

•Operational risk. Operational risk refers to the risk arising from inadequate or failed internal processes or systems, the misconduct or errors of people or adverse external events. We seek to mitigate operational risks by expanding our operations team and training; working with our vendors to use antifraud protections; establishing security procedures for our clients; and engaging in periodic independent audits of our operations and operating controls. We also seek to mitigate operational risks related to misconduct by employees or contractors by implementing internal controls, including dual authorization for monetary transactions, conducting background and credit checks for new hires, screening contractors and third parties providing critical services using a vendor management process, and offering whistleblower protections to our employees to encourage the reporting of misconduct.

•Compliance risk. Compliance risk refers to the risk arising from violations of, or nonconformance with, laws, rules, regulations, prescribed practices, policies and procedures, or ethical standards. We have implemented a compliance training program for our employees that includes policies, training, monitoring and change management. We engage an outside firm to monitor our compliance functions on a quarterly basis.

•Strategic risk. Strategic risk refers to the risk arising from adverse business decisions, improper implementation of decisions, or lack of responsiveness to changes in the banking industry and operating environment. Our Board is

13

charged with overseeing our corporate strategy, and our Risk Committee oversees strategic risks and the control processes with respect to such risks.

We also seek to monitor our exposure to cyber risk, which generally refers to the risk arising from inadequate or failed information technology systems, vulnerabilities to internal information technology networks, engineered breaches of client information or inadequate information technology policies and procedures. Given the rapidly changing cybersecurity landscape, we evaluate our cyber risk management practices regularly, which may include testing the security of our information technology infrastructure, incident response planning, employee training, engaging third parties to conduct independent reviews and audits, scanning for internal vulnerabilities and adopting measures designed to help our clients stay protected against cybersecurity threats.

Our Board, both directly and through its committees, is responsible for overseeing our risk management processes. In particular, our Risk Committee oversees our enterprise-wide risk management activities, our financial and operational risks (including, without limitation, capital adequacy, compliance, credit, liquidity, market, operational, strategic, asset and reputational risks and the control processes with respect to such risks), and our risk appetite and tolerance. In addition, the Bank’s Information Technology Committee oversees the Bank’s cybersecurity initiatives and strives to ensure that the Bank’s information technology infrastructure aligns with strategic goals while managing related risks, particularly cybersecurity threats. The Information Technology Committee also reviews and updates the Bank’s cybersecurity policies, evaluates information technology controls, and monitors the performance of internal and third-party IT service providers as part of its efforts to enhance the Bank’s defense mechanisms.

Intellectual Property

Our intellectual property is important to the success of our business. We own a variety of trademarks, service marks, trade names, logos and other intellectual property, including the trademarks “Chain Bridge Bank,” “Chain Bridge Bank, N.A.,” “Chain Bridge Bank, N.A. Trust & Wealth,” and “Chain Bridge Bank, N.A. Mortgage,” which we have registered with the United States Patent and Trademark Office. We intend to protect the use of our trademarks and other intellectual property nationwide.

Human Resources

As of December 31, 2024, we employed 84 full-time employees. None of our employees is party to a collective bargaining agreement. We consider our relationship with our employees to be excellent and have not experienced interruptions of operations due to labor disagreements.

Our success depends on our ability to attract, develop and retain qualified professionals. We offer competitive compensation and benefits designed to attract and retain top talent. We offer a short-term cash incentive compensation plan (the “Incentive Compensation Plan”) for which all employees of the Bank as of the end of the fiscal year are eligible. The Incentive Compensation Plan focuses on both financial results and risk management and is designed to incentivize prudent and profitable growth by rewarding participants based on the performance of the Company as a whole, rather than individual achievement, in order to promote teamwork and collaboration among employees. We also administer a long-term cash incentive plan to incentivize and retain key employees of the Bank and encourage participants to contribute to the long-term increase of the Company’s retained earnings.

The Company uses talent development and succession planning to promote leadership continuity and operational stability. We prioritize internal promotion to maintain cultural continuity and minimize leadership transition risks. Management invests in human capital in several specific areas, such as: encouraging participation in leadership and management training programs; providing required annual skills training focusing on areas such banking, finance, technology and regulatory compliance; and supporting continuous professional development by offering educational benefits for employees to gain additional relevant expertise and certifications.

The Company seeks to foster a strong and collaborative workplace culture through regular all-staff meetings led by our CEO that provide ongoing training, discussions on Bank operations and strategic initiatives, employee recognition, and an open forum for questions. We believe our leadership’s commitment to a positive tone at the top cultivates an inclusive and engaged workforce contributing to low staff turnover and encouraging innovation and teamwork across departments. We believe this translates to value added for our clients and shareholders.

Supervision and Regulation

The Company and the Bank are subject to extensive regulation under federal and state law. The following information describes certain aspects of that regulation applicable to the Company and the Bank and does not purport to be complete. The costs of compliance with the regulatory regime and supervisory framework applicable to the Company and the Bank are significant. The level of regulation and oversight over financial services activities, including the regulatory enforcement environment applicable to banks and bank holding companies, has in the past increased, and may in the future

14

increase. The laws, regulations and supervisory guidance applicable to the Company and the Bank are subject to frequent and ongoing change. A change in applicable laws, regulations or policies, or a change in the way such laws, regulations, or policies are interpreted or enforced by regulatory agencies or courts, may have a material impact on the business, operations, and earnings of the Company and the Bank. The likelihood and timing of any future changes, and the effect of such changes on the Company and the Bank, are not determinable at this time with any degree of certainty.

Chain Bridge Bancorp, Inc.

The Company is a bank holding company organized under the laws of Delaware within the meaning of the BHC Act, and is registered as such with the Federal Reserve. As a bank holding company, the Company is subject to supervision, regulation, and examination by the Federal Reserve and is required to file various reports with the Federal Reserve, including FR Y-9SP (Parent Company Only Financial Statements for Small Holding Companies).

Under the BHC Act, a bank holding company may elect to become a financial holding company and thereby engage in a broader range of financial and other activities than are permissible for traditional bank holding companies. The Company has not elected to become a financial holding company and has no immediate plans to become a financial holding company.

Chain Bridge Bank, National Association

The Bank is a national bank chartered under the laws of the United States and is subject to supervision, regulation, periodic examination, enforcement authority and oversight by the OCC, Charter Number 24755, and is required to file Call Reports on a quarterly basis with the FFIEC and various other reports and additional information with the OCC. The OCC has primary supervisory and regulatory authority over the operations of the Bank. The OCC has broad enforcement powers over national banks, such as the Bank, including the power to impose fines and other civil and criminal penalties and to appoint a conservator or receiver if any of a number of conditions are met. In addition to its supervisory and regulatory oversight over banking operations, the OCC also undertakes examinations and supervision of the fiduciary activities of the Bank, as described further under “— Permitted Activities” below.

As the Bank is a member of the FDIC and accepts FDIC-insured deposits from the public, it is subject to additional regulatory oversight by the FDIC. As a result, the Bank is subject to the FDIC’s deposit insurance requirements. The Bank’s FDIC membership is confirmed under Certificate Number 58595.

Depository institutions, including the Bank, are subject to extensive federal regulations that significantly affect their businesses and activities. Regulatory bodies have broad authority to implement standards and initiate proceedings designed to prohibit depository institutions from engaging in unsafe and unsound banking practices. The standards relate generally to operations and management, asset quality, interest rate exposure, and capital. The bank regulatory agencies are authorized to take action against institutions that fail to meet such standards.

As required for national banks, the Bank is a member of the Federal Reserve and has subscribed for stock in the Federal Reserve in an amount equal to 6% of its capital and surplus, of which 3% was paid upon becoming a member of the Federal Reserve and 3% is held in reserve and callable by the Federal Reserve.

The Dodd-Frank Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), signed into law in July 2010, significantly restructured the financial regulatory regime in the United States and has had a broad impact on the financial services industry as a result of the significant regulatory and compliance changes required under the act.

The Economic Growth, Regulatory Relief and Consumer Protection Act of 2018 (the “EGRRCPA”), which became effective May 24, 2018, amended the Dodd-Frank Act to provide regulatory relief for certain smaller and regional financial institutions, such as the Company and the Bank. The EGRRCPA, among other things, provides financial institutions with less than $10 billion in total consolidated assets with relief from certain capital requirements. The EGRRCPA also expanded the category of bank holding companies that may rely on the Federal Reserve’s Small Bank Holding Company Policy Statement (the “SBHC Policy Statement”) by raising the maximum amount of consolidated assets a qualifying bank holding company may have from $1 billion to $3 billion. In addition to meeting the asset threshold, a bank holding company must not engage in significant nonbanking activities, not conduct significant off-balance sheet activities, and not have a material amount of debt or equity securities outstanding and registered with the SEC (subject to certain exceptions). The Federal Reserve may, in its discretion, exclude any bank holding company from the application of the SBHC Policy Statement if such action is warranted for supervisory purposes.

Deposit Insurance

The Bank accepts deposits that are insured by the FDIC up to the applicable limits. Under the FDIA, the FDIC may terminate the insurance of an institution’s deposits upon a finding that the institution has engaged in unsafe or unsound

15

practices; is in an unsafe or unsound condition to continue operations; or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC. We do not know of any practice, condition or violation that might lead to termination of deposit insurance at the Bank. The FDIC’s DIF is funded by assessments on insured depository institutions, including the Bank, which are subject to adjustment by the FDIC.

On October 18, 2022, the FDIC adopted a final rule to increase base deposit insurance assessment rate schedules uniformly by two basis points beginning in the first quarterly assessment period of 2023. The increase is being instituted to account for extraordinary growth in insured deposits during the first and second quarters of 2020, which caused a substantial decrease in the “designated reserve ratio” of the DIF to total industry deposits. The FDIC has indicated that the new assessment rate schedules will remain in effect until the DIF reserve ratio meets or exceeds 2%.

Capital Requirements

The Federal Reserve, the OCC, and the FDIC have issued substantially similar capital requirements applicable to all banks and bank holding companies. In addition, those regulatory agencies may from time to time require that a banking organization maintain capital above the minimum levels because of its financial condition or actual or anticipated growth.

As a bank holding company with less than $3 billion in total consolidated assets, the Company is currently treated as a “small bank holding company” under the Federal Reserve’s SBHC Policy Statement and is exempt from the Federal Reserve’s consolidated risk-based capital and leverage rules at the holding company level. Although the Company expects to continue to be treated as “small bank holding company” under the SBHC Policy Statement, the Federal Reserve has significant discretion to determine whether a publicly traded bank holding company (or any bank holding company) may continue to rely on the SBHC Policy Statement. If the Company continues to be treated as a “small bank holding company,” the Company’s capital adequacy will be evaluated at the bank level and on a parent-only basis, and it would not be subject to consolidated capital standards for regulatory purposes. If the Company in the future is advised by the Federal Reserve that it may no longer rely on the SBHC Policy Statement, the Company will become subject to the Federal Reserve’s consolidated capital standards applicable to bank holding companies. The Company believes that it would be able to satisfy the Federal Reserve’s consolidated capital rules.

The Bank is subject to the rules implementing the Basel III capital framework and certain related provisions of the Dodd-Frank Act (the “Basel III Capital Rules”). Under the Basel III Capital Rules, banks must hold a capital conservation buffer above the adequately capitalized risk-based capital ratio of 2.50% for all ratios except the Tier 1 leverage ratio. The Basel III Capital Rules, effective January 1, 2015, require the Bank to comply with the following minimum capital ratios: (i) a ratio of common equity Tier 1 capital to risk-weighted assets of at least 4.50%, plus a 2.50% “capital conservation buffer” (effectively resulting in a minimum ratio of common equity Tier 1 capital to risk-weighted assets of 7.00%); (ii) a ratio of Tier 1 capital to risk-weighted assets of at least 6.00%, plus the 2.50% capital conservation buffer (effectively resulting in a minimum Tier 1 capital ratio of 8.50%); (iii) a ratio of total capital to risk-weighted assets of at least 8.00%, plus the 2.50% capital conservation buffer (effectively resulting in a minimum total capital ratio of 10.50%); and (iv) a leverage ratio of 4.00%, calculated as the ratio of Tier 1 capital to average assets (the “Tier 1 Leverage ratio”). The capital conservation buffer is designed to absorb losses during periods of economic stress. Banking institutions with a ratio of common equity Tier 1 capital to risk-weighted assets above the minimum but below the conservation buffer face constraints on dividends, equity repurchases, and compensation, based on the amount of the shortfall.

With respect to banks, the “prompt corrective action” regulations pursuant to Section 38 of the FDIA require, among other things, that federal bank regulators take “prompt corrective action” with respect to institutions that do not meet minimum capital requirements. For this purpose, the law establishes five capital categories: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. At each successive lower capital category, an insured depository institution is subject to more restrictions and prohibitions, including restrictions on growth, restrictions on interest rates paid on deposits, restrictions or prohibitions on payment of dividends, and restrictions on the acceptance of brokered deposits. To be well capitalized under these regulations, a bank must have the following minimum capital ratios: (i) a common equity Tier 1 capital ratio of at least 6.50%; (ii) a Tier 1 capital to risk-weighted assets ratio of at least 8.00%; (iii) a total capital to risk-weighted assets ratio of at least 10.00%; and (iv) a Tier 1 Leverage ratio of at least 5.00%.

In September 2019, the federal banking agencies jointly issued a final rule required by the EGRRCPA that permits qualifying banks and bank holding companies that have less than $10 billion in consolidated assets to elect to be subject to a 9% leverage ratio that would be applied using less complex leverage calculations (commonly referred to as the community bank leverage ratio or “CBLR”). Under the rule, which became effective on January 1, 2020, banks and bank holding companies that opt into the CBLR framework and maintain a CBLR of greater than 9% are not subject to other risk-based and leverage capital requirements under the Basel III Capital Rules and would be deemed to have met the well-capitalized ratio requirements under the “prompt corrective action” framework. The Bank has not opted into the CBLR framework.

16

Enforcement Actions and Receivership

In addition to measures taken under the “prompt corrective action” regulations, insured banks may be subject to potential enforcement actions by the federal banking agencies for unsafe or unsound practices in conducting their businesses or for violations of any law, rule, regulation, or condition imposed in writing by the agency or any written agreement with the agency. Enforcement actions may include the imposition of a conservator or receiver, the issuance of a cease-and-desist order that can be judicially enforced, the termination of insurance of deposits (in the case of a depository institution), the imposition of civil money penalties, the requirement to make restitution payments to clients who have experienced an economic loss due to bank actions, the issuance of directives to increase capital, the issuance of formal and informal agreements, the issuance of removal, and prohibition orders against institution-affiliated parties. The enforcement of such actions through injunctions or restraining orders may be based upon a judicial determination that the agency would be harmed if such equitable relief was not granted.

If the FDIC is appointed the conservator or receiver of the Bank, the FDIC has the power: (1) to transfer any of the Bank’s assets and liabilities to a new obligor without the approval of the Bank’s creditors; (2) to enforce the terms of the Bank’s contracts pursuant to their terms; or (3) to repudiate or disaffirm any contract or lease to which the Bank is a party, the performance of which is determined by the FDIC to be burdensome and the disaffirmation or repudiation of which is determined by the FDIC to promote the orderly administration of the Bank. In addition, the claims of holders of U.S. deposit liabilities and certain claims for administrative expenses of the FDIC against the Bank would be afforded priority over other general unsecured claims against the Bank, including claims of debt holders and depositors in non-U.S. offices, in the liquidation or other resolution of the Bank. As a result, whether or not the FDIC ever sought to repudiate any debt obligations of the Bank, the debt holders and depositors in non-U.S. offices would be treated differently from, and could receive substantially less, if anything, than the depositors in the U.S. offices of the Bank.

Dividends

The Company’s ability to pay dividends or repurchase shares of its common stock is subject to restrictions set forth in the DGCL. The DGCL provides that a Delaware corporation may pay dividends or repurchase its shares either (i) out of the corporation’s surplus (as defined by Delaware law) or (ii) if there is no surplus, out of the corporation’s net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. It is the Federal Reserve’s policy, however, that bank holding companies should generally pay dividends on common stock only out of income available over the previous four quarters, and only if prospective earnings retention is consistent with the organization’s expected future needs and financial condition. Federal Reserve policy requires that a bank holding company must notify the Federal Reserve if its dividends or repurchase or redemption of shares would cause a net reduction in the amount of such capital instrument outstanding at the beginning of the quarter in which the redemption or repurchase occurs. It is also the Federal Reserve’s policy that bank holding companies should not maintain dividend levels or repurchase shares in amounts that would undermine their ability to be a source of strength to their banking subsidiaries. The Federal Reserve also discourages dividend payment ratios that are at maximum allowable levels unless both asset quality and capital are very strong. In addition, if the Company does not maintain an adequate capital conservation buffer under the Basel III Capital Rules, its ability to pay dividends to or repurchase shares from stockholders may be restricted.

The Bank is a legal entity that is separate and distinct from the Company. The Company’s principal source of cash flow is dividends it receives from the Bank. Statutory and regulatory limitations apply to the Bank’s payment of dividends to the Company. As a general rule, the amount of a dividend may not exceed, without prior regulatory approval, the sum of net income in the calendar year to date and the retained net earnings of the immediately preceding two calendar years. A depository institution may not pay any dividend if payment would cause the institution to become “undercapitalized” or if it already is “undercapitalized.” The OCC may prevent the payment of a dividend if it determines that the payment would be an unsafe and unsound banking practice. The OCC also has advised that a national bank should generally pay dividends only out of current operating earnings.

Permitted Activities

As a bank holding company, the Company is limited generally to managing or controlling banks, furnishing services to or performing services for its subsidiaries, and engaging in other activities that the Federal Reserve determines by regulation or order to be so closely related to banking or managing or controlling banks as to be a proper incident thereto. Other than its ownership and management of the Bank, the Company does not engage in any other material business.

The Bank is authorized to engage in activities permissible for national banks under federal law. On March 5, 2020, the OCC granted the Bank separate authorization to perform fiduciary activities. The Bank initiated these activities on September 18, 2020 with the opening of its Trust & Wealth Department. The Bank is authorized to perform a range of fiduciary services, including serving as trustee, investment manager with sole or joint discretion, executor, administrator, registrar of stocks and bonds, and guardian of estates. Some states have physical presence requirements for trust services,

17

and the interplay between federal and state regulations in this area continues to evolve. The Bank’s fiduciary activities are subject to the supervision, examination and regulation of the OCC, which, among other things, requires adherence to conflict of interest rules, rigorous record-keeping requirements, and regular audits and internal controls to maintain the integrity of fiduciary activities.

Banking Acquisitions; Changes in Control

The BHC Act requires, among other things, the prior approval of the Federal Reserve in any case where a bank holding company proposes to (i) acquire direct or indirect ownership or control of more than 5% of the outstanding voting stock of any bank or bank holding company (unless it already owns a majority of such voting shares), (ii) acquire all or substantially all of the assets of another bank or bank holding company, or (iii) merge or consolidate with any other bank holding company. In determining whether to approve a proposed bank acquisition, the Federal Reserve will consider, among other factors, the effect of the acquisition on competition, the effect of the transaction on the convenience and needs of the community to be served, and the projected capital ratios and levels on a post-acquisition basis, as well as the acquiring institution’s performance under the CRA and its compliance with fair housing and other consumer protection laws.

In addition, Section 18(c) of the FDIA, commonly known as the “Bank Merger Act,” requires the prior written approval of the OCC before any national bank may (i) merge or consolidate with, (ii) purchase or otherwise acquire the assets of or (iii) assume the deposit liabilities of another bank if the resulting institution is to be a national bank. In determining whether to approve a proposed merger transaction, the OCC must consider the effect on competition, the financial and managerial resources and future prospects of the existing and resulting institutions, the convenience and needs of the communities to be served, and the effectiveness of each insured depository institution involved in the proposed merger transaction in combating money-laundering activities.

In acting on any application by a banking organization to make an investment or acquisition subject to its approval, federal banking regulators have substantial discretion in whether or not to grant any approval or non-objection. If the Company or the Bank were to fail to meet certain regulatory criteria or expectations, it could have a material negative effect on the Company’s or the Bank’s ability to obtain the approvals and non-objections necessary to engage in investments or acquisitions.