EX-99.1

Published on September 3, 2025

INVESTOR PRESENTATION

2 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Forward-Looking Statements This Presentation contains forward-looking statements within the meaning of U.S. federal securities laws, which involve risks and uncertainties. You should not place undue reliance on forward- looking statements because they are subject to numerous uncertainties and factors relating to our operations and business, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These forward-looking statements are generally identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and, in each case, their negative or other variations or comparable terminology and expressions. All statements other than statements of historical facts contained in this Presentation, including statements regarding our strategies, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. The forward-looking statements contained in this Presentation include, among other things, statements relating to: (i) changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks or similar organizations, including the effects of United States federal government spending and tariffs; (ii) the level of, or changes in the level of, interest rates and inflation, including the effects on our net interest income, noninterest income, and the market value of our investment and loan portfolios; (iii) the level and composition of our deposits, including our ability to attract and retain, and the seasonality of, client deposits, including those in the ICS® network, as well as the amount and timing of deposit inflows and outflows and the concentration of our deposits; (iv) our future net interest margin, net interest income, net income, and return on equity; (v) our political organization clients’ fundraising and disbursement activities; (vi) the level and composition of our loan portfolio, including our ability to maintain the credit quality of our loan portfolio; (vii) current and future business, economic and market conditions in the United States generally or in the Washington, D.C. metropolitan area in particular; (viii) the effects of disruptions or instability in the financial system, including as a result of the failure of a financial institution or other participants in it, or geopolitical instability, including war, terrorist attacks, pandemics and man-made and natural disasters; (ix) the impact of, and changes in, applicable laws, regulations, regulatory expectations and accounting standards and policies; (x) our likelihood of success in, and the impact of, legal, regulatory or other actions, investigations or proceedings related to our business; (xi) adverse publicity or reputational harm to us, our senior officers, directors, employees or clients; (xii) our ability to effectively execute our growth plans or other initiatives; (xiii) changes in demand for our products and services; (xiv) our levels of, and access to, sources of liquidity and capital; (xv) the ability to attract and retain essential personnel or changes in our essential personnel; (xvi) our ability to effectively compete with banks, non-bank financial institutions, and financial technology firms and the effects of competition in the financial services industry on our business; (xvii) the effectiveness of our risk management and internal disclosure controls and procedures; (xviii) any failure or interruption of our information and technology systems, including any components provided by a third party; (xix) our ability to identify and address cybersecurity threats and breaches; (xx) our ability to keep pace with technological changes; (xxi) our ability to receive dividends from the Bank and satisfy our obligations as they become due; (xxii) the incremental costs of operating as a public company; (xxiii) our ability to meet our obligations as a public company, including our obligation under Section 404 of the Sarbanes-Oxley Act; and (xxiv) the effect of our dual-class structure and the concentrated ownership of our Class B common stock, including beneficial ownership of our shares by members of the Fitzgerald Family (as defined in our Quarterly Report on Form 10-Q dated June 30, 2025, as filed with the U.S. Securities and Exchange Commission in accordance with Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, on August 12, 2025). You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Presentation. While we believe such information provides a reasonable basis for such statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements. Past performance is not a guarantee of future results or returns and no representation or warranty is made regarding future performance. Cautionary Note Regarding Forward-Looking Statements

3 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Our Executive Management Team Peter G. Fitzgerald Chairman of the Board John J. Brough II Chief Executive Officer and Director David M. Evinger President, Director, and Chief Risk Officer (Company and Bank), and Chief Credit Officer (Bank) Joanna R. Williamson Executive Vice President and Chief Financial Officer Hilary E. Albrecht Senior Vice President, Counsel and Corporate Secretary James R. Pollock Senior Vice President, Corporate Development Officer (Company), and Chief Commercial Lending Officer (Bank)

4 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Chain Bridge Bancorp, Inc. is a Delaware-chartered bank holding company and the parent of its wholly-owned subsidiary, Chain Bridge Bank, N.A., a nationally chartered commercial bank with fiduciary powers granted by the Office of the Comptroller of the Currency. ● Founded: Incorporated on May 26, 2006; Bank opened August 6, 2007 ● Trust Powers: Granted by the OCC on March 5, 2020; trust activities initiated on September 18, 2020 ● Headquarters: McLean, VA (approximately 5 miles from Washington, D.C.) ● IPO: October 2024 o Issued 1,992,897 shares of Class A common stock, par value $0.01 per share, at $22.00 per share o IPO and partial exercise of the underwriters’ over-allotment option resulted in approximately $36.5 million in net proceeds to the Company ● Listing: Traded on the New York Stock Exchange (NYSE) under ticker symbol “CBNA” ● Index Membership: As of June 30, 2025, the Company was added to the Russell 3000® Index and certain other Russell indices. Membership in these indices is determined annually by FTSE Russell and is subject to change. Company Overview

5 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins ● Class A Common Stock: 3,151,496 shares outstanding o Publicly traded o Entitled to one vote per share ● Class B Common Stock: 3,410,321 shares outstanding o Entitled to 10 votes per share o Each share is convertible, at the option of the holder, into one share of Class A Common Stock, subject to the terms and conditions set forth in the Company’s Certificate of Incorporation. ● Except with respect to voting and conversion rights, the rights of Class A and Class B Common Stock are identical, the classes rank equally and share ratably in all other matters. ● Holders of Class B Common Stock, including members of the Fitzgerald Family, collectively hold a majority of the voting power of the Company. See our Annual Report on Form 10-K for related risks. Share Structure (as of August 11, 2025)

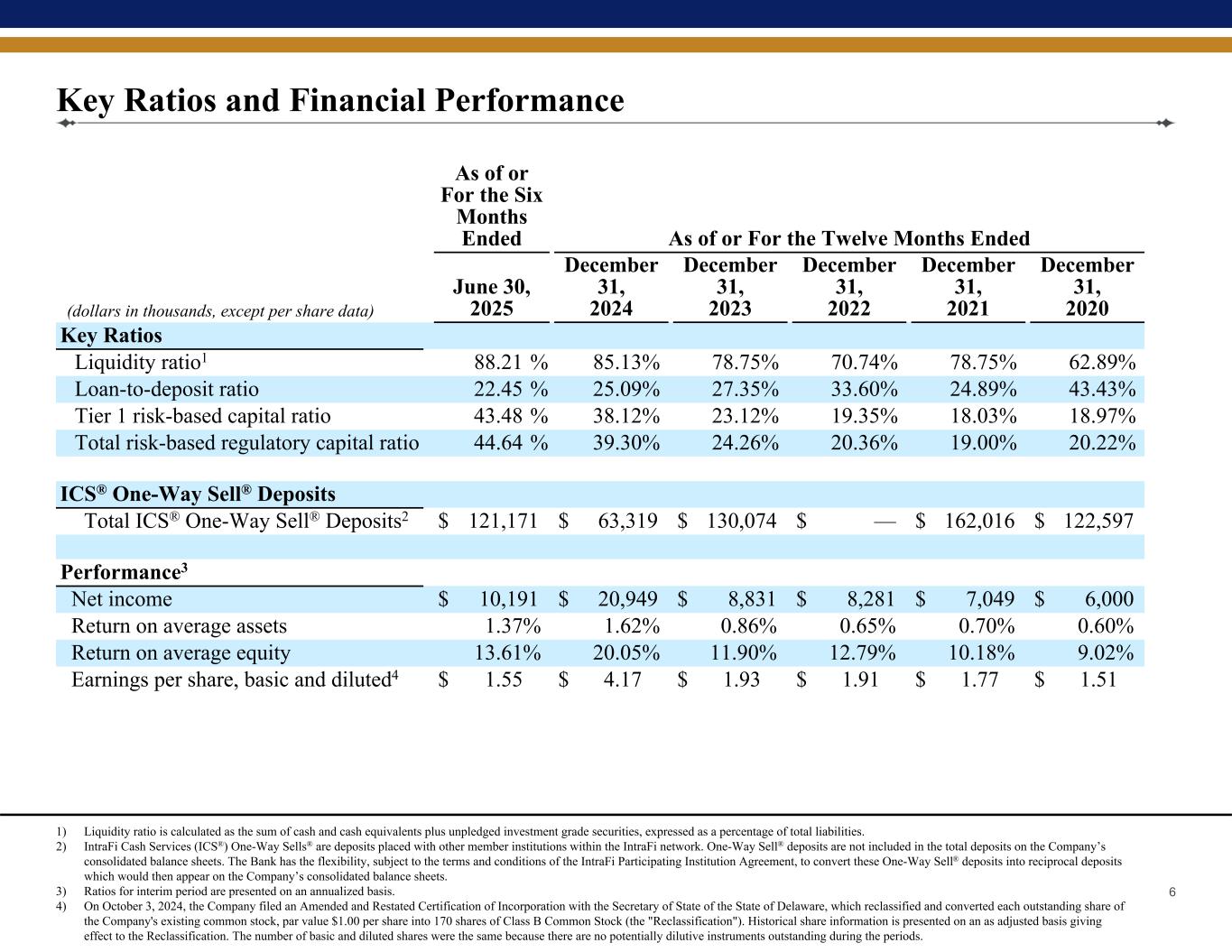

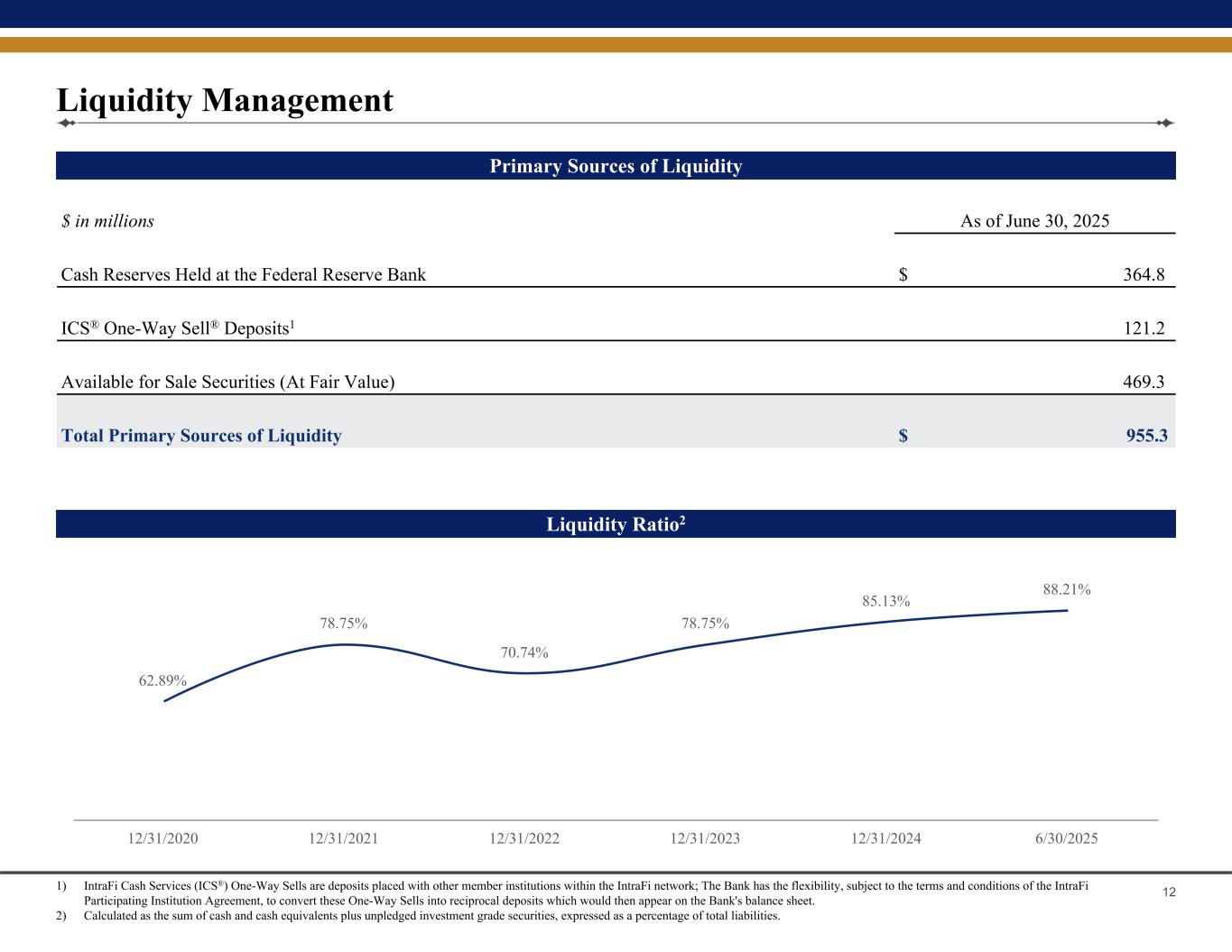

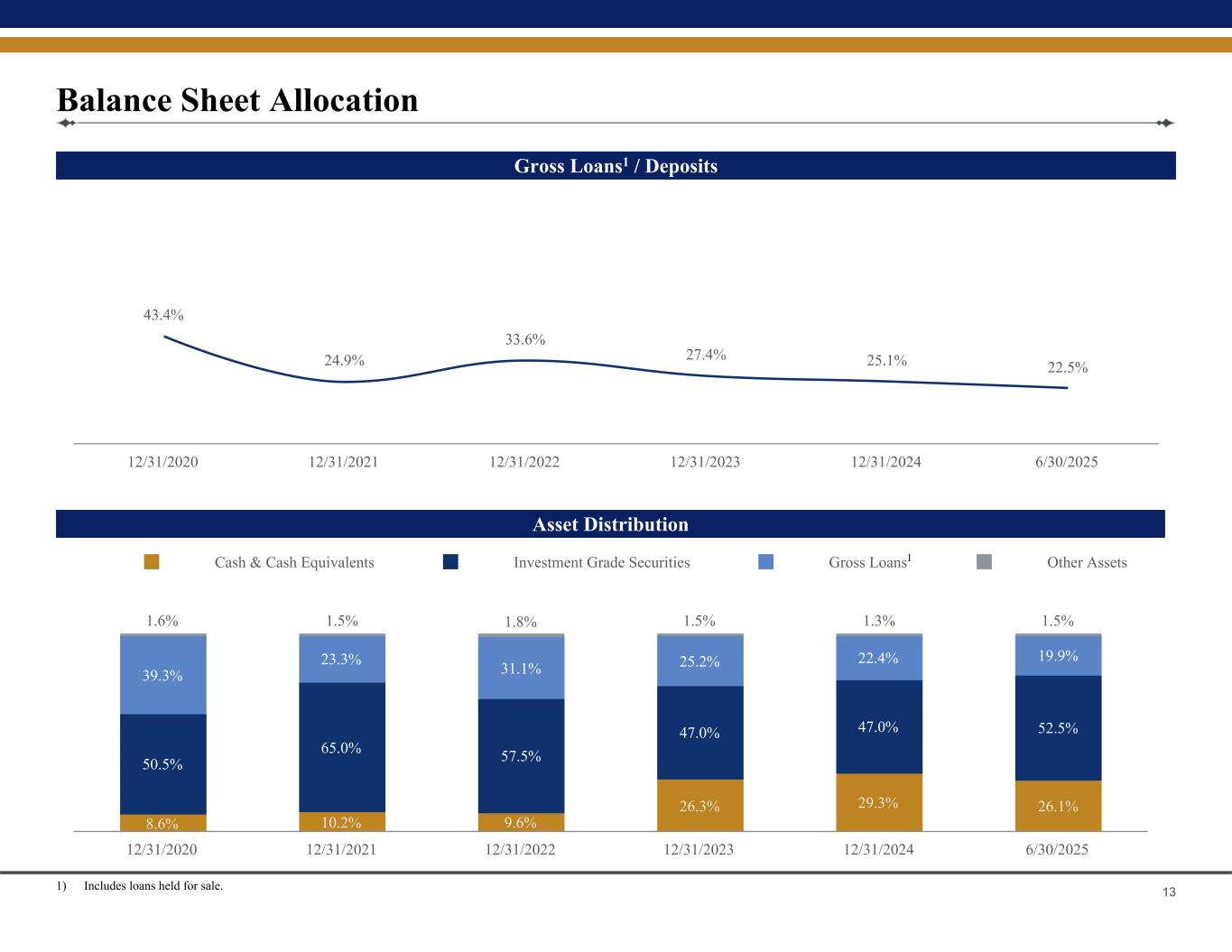

6 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Key Ratios and Financial Performance As of or For the Six Months Ended As of or For the Twelve Months Ended (dollars in thousands, except per share data) June 30, 2025 December 31, 2024 December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Key Ratios Liquidity ratio1 88.21 % 85.13% 78.75% 70.74% 78.75% 62.89% Loan-to-deposit ratio 22.45 % 25.09% 27.35% 33.60% 24.89% 43.43% Tier 1 risk-based capital ratio 43.48 % 38.12% 23.12% 19.35% 18.03% 18.97% Total risk-based regulatory capital ratio 44.64 % 39.30% 24.26% 20.36% 19.00% 20.22% ICS® One-Way Sell® Deposits Total ICS® One-Way Sell® Deposits2 $ 121,171 $ 63,319 $ 130,074 $ — $ 162,016 $ 122,597 Performance3 Net income $ 10,191 $ 20,949 $ 8,831 $ 8,281 $ 7,049 $ 6,000 Return on average assets 1.37% 1.62% 0.86 % 0.65 % 0.70 % 0.60 % Return on average equity 13.61% 20.05% 11.90 % 12.79 % 10.18 % 9.02 % Earnings per share, basic and diluted4 $ 1.55 $ 4.17 $ 1.93 $ 1.91 $ 1.77 $ 1.51 1) Liquidity ratio is calculated as the sum of cash and cash equivalents plus unpledged investment grade securities, expressed as a percentage of total liabilities. 2) IntraFi Cash Services (ICS®) One-Way Sells® are deposits placed with other member institutions within the IntraFi network. One-Way Sell® deposits are not included in the total deposits on the Company’s consolidated balance sheets. The Bank has the flexibility, subject to the terms and conditions of the IntraFi Participating Institution Agreement, to convert these One-Way Sell® deposits into reciprocal deposits which would then appear on the Company’s consolidated balance sheets. 3) Ratios for interim period are presented on an annualized basis. 4) On October 3, 2024, the Company filed an Amended and Restated Certification of Incorporation with the Secretary of State of the State of Delaware, which reclassified and converted each outstanding share of the Company's existing common stock, par value $1.00 per share into 170 shares of Class B Common Stock (the "Reclassification"). Historical share information is presented on an as adjusted basis giving effect to the Reclassification. The number of basic and diluted shares were the same because there are no potentially dilutive instruments outstanding during the periods.

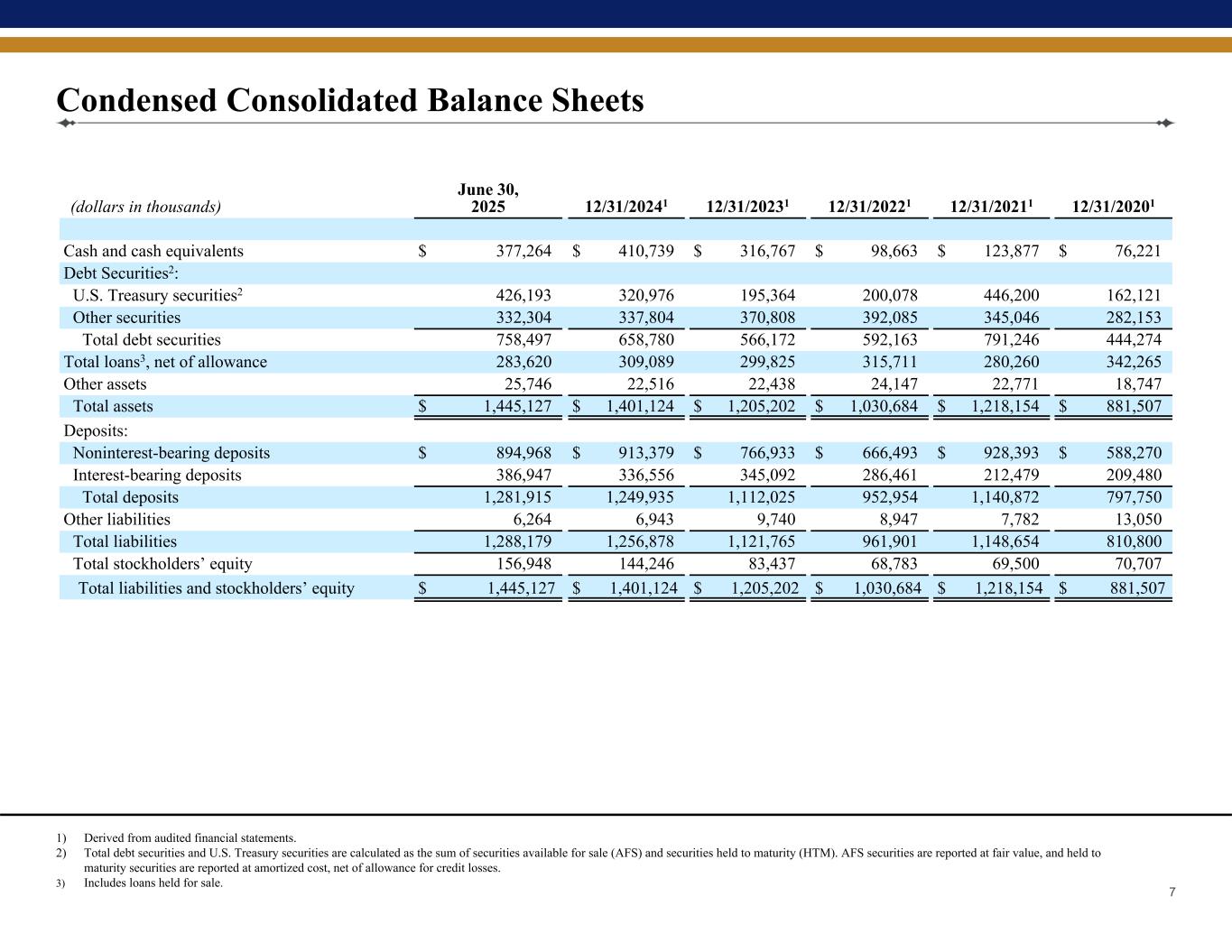

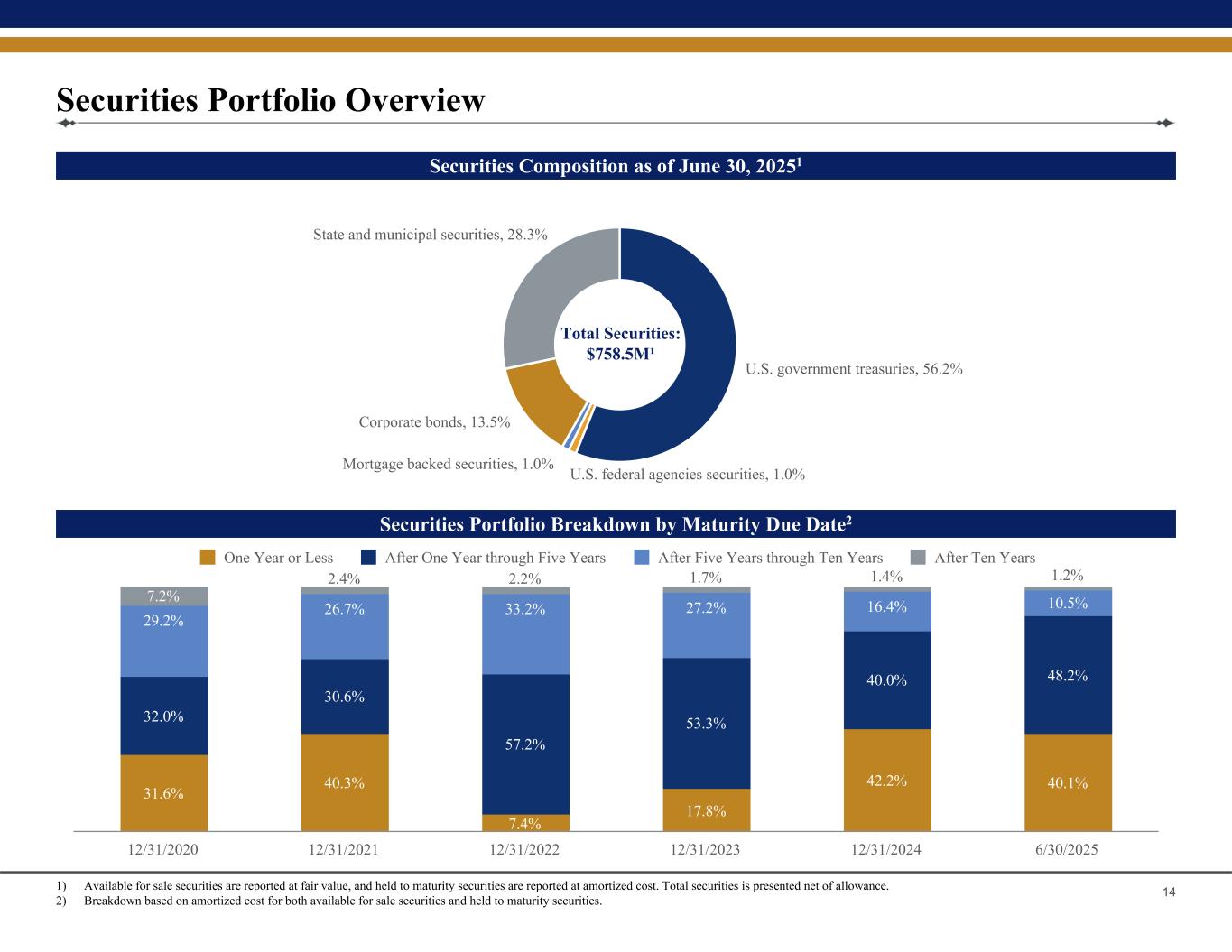

7 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Condensed Consolidated Balance Sheets (dollars in thousands) June 30, 2025 12/31/20241 12/31/20231 12/31/20221 12/31/20211 12/31/20201 Cash and cash equivalents $ 377,264 $ 410,739 $ 316,767 $ 98,663 $ 123,877 $ 76,221 Debt Securities2: U.S. Treasury securities2 426,193 320,976 195,364 200,078 446,200 162,121 Other securities 332,304 337,804 370,808 392,085 345,046 282,153 Total debt securities 758,497 658,780 566,172 592,163 791,246 444,274 Total loans3, net of allowance 283,620 309,089 299,825 315,711 280,260 342,265 Other assets 25,746 22,516 22,438 24,147 22,771 18,747 Total assets $ 1,445,127 $ 1,401,124 $ 1,205,202 $ 1,030,684 $ 1,218,154 $ 881,507 Deposits: Noninterest-bearing deposits $ 894,968 $ 913,379 $ 766,933 $ 666,493 $ 928,393 $ 588,270 Interest-bearing deposits 386,947 336,556 345,092 286,461 212,479 209,480 Total deposits 1,281,915 1,249,935 1,112,025 952,954 1,140,872 797,750 Other liabilities 6,264 6,943 9,740 8,947 7,782 13,050 Total liabilities 1,288,179 1,256,878 1,121,765 961,901 1,148,654 810,800 Total stockholders’ equity 156,948 144,246 83,437 68,783 69,500 70,707 Total liabilities and stockholders’ equity $ 1,445,127 $ 1,401,124 $ 1,205,202 $ 1,030,684 $ 1,218,154 $ 881,507 1) Derived from audited financial statements. 2) Total debt securities and U.S. Treasury securities are calculated as the sum of securities available for sale (AFS) and securities held to maturity (HTM). AFS securities are reported at fair value, and held to maturity securities are reported at amortized cost, net of allowance for credit losses. 3) Includes loans held for sale.

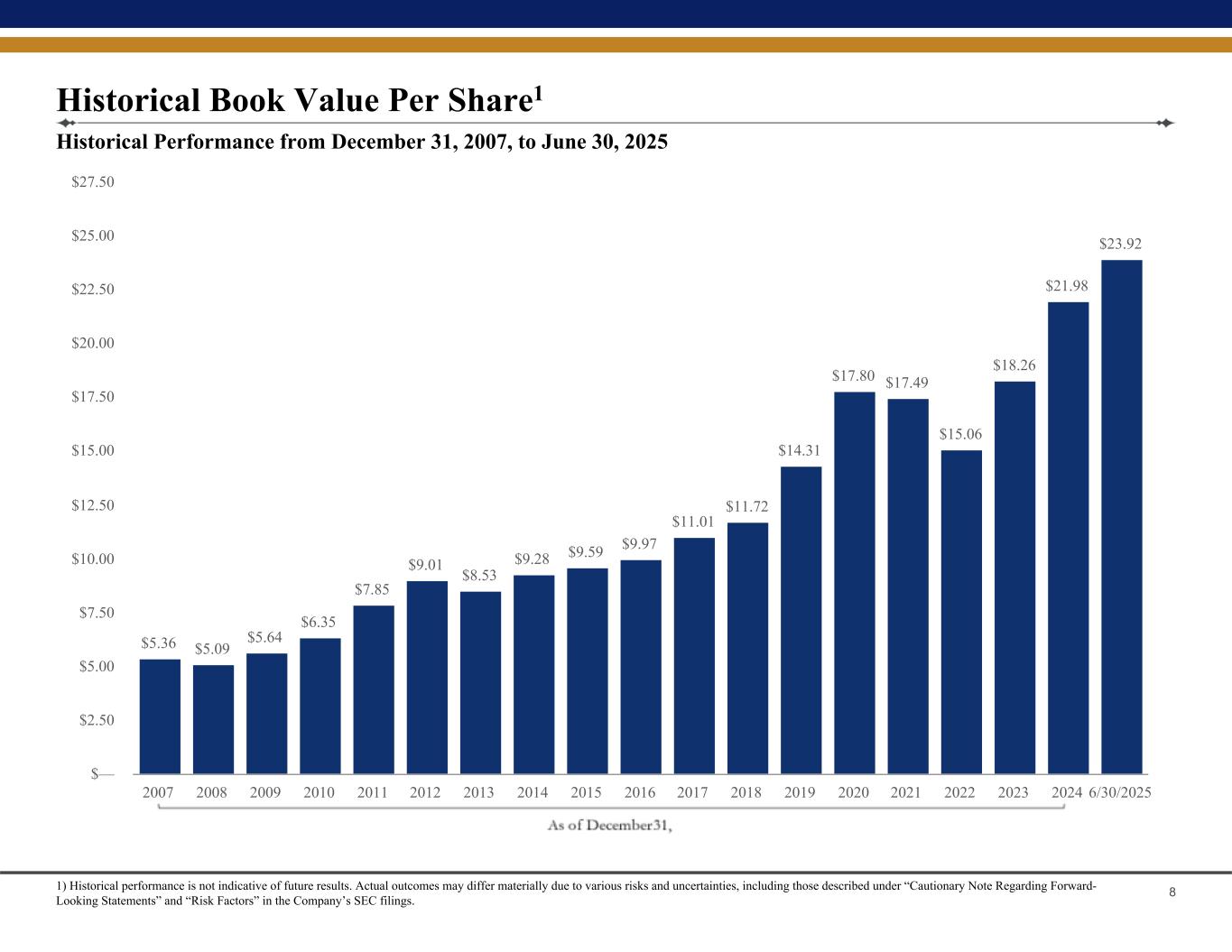

8 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) Historical performance is not indicative of future results. Actual outcomes may differ materially due to various risks and uncertainties, including those described under “Cautionary Note Regarding Forward- Looking Statements” and “Risk Factors” in the Company’s SEC filings. Historical Performance from December 31, 2007, to June 30, 2025 Historical Book Value Per Share1 $5.36 $5.09 $5.64 $6.35 $7.85 $9.01 $8.53 $9.28 $9.59 $9.97 $11.01 $11.72 $14.31 $17.80 $17.49 $15.06 $18.26 $21.98 $23.92 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 6/30/2025 $— $2.50 $5.00 $7.50 $10.00 $12.50 $15.00 $17.50 $20.00 $22.50 $25.00 $27.50

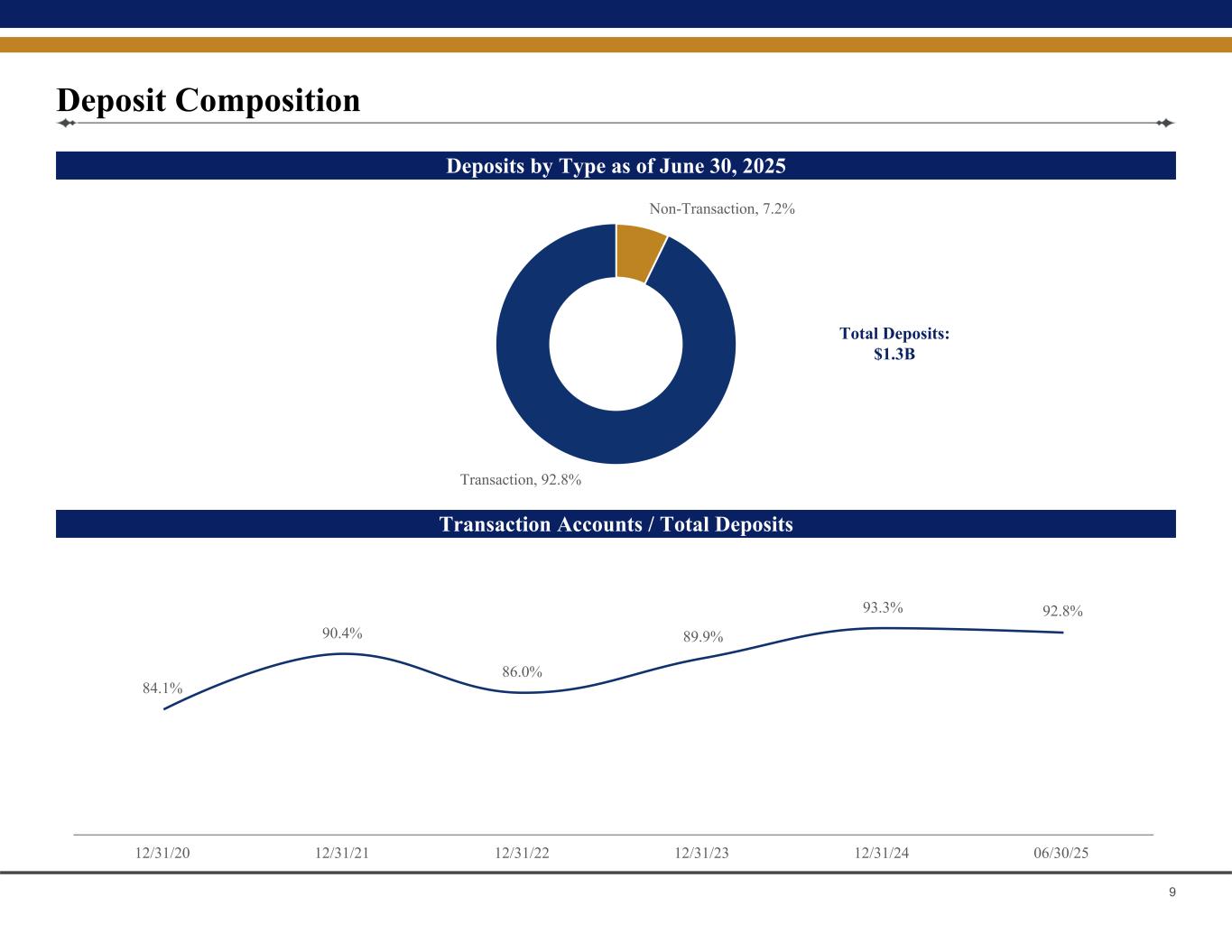

9 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Transaction Accounts / Total Deposits Deposits by Type as of June 30, 2025 Deposit Composition Total Deposits: $1.3B 84.1% 90.4% 86.0% 89.9% 93.3% 92.8% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 Non-Transaction, 7.2% Transaction, 92.8%

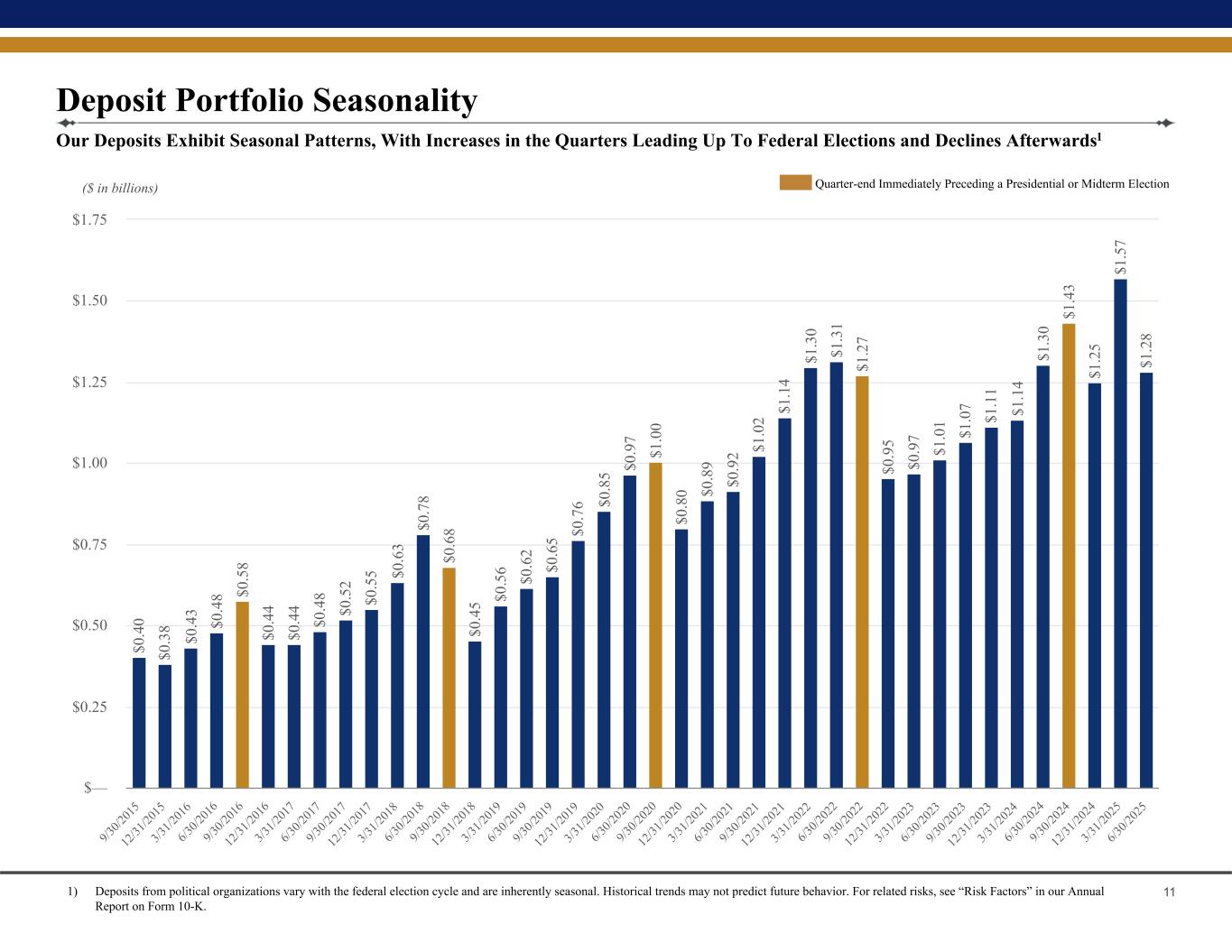

10 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Experience in Serving Political Organizations ● Political organizations have historically represented a significant part of our deposit base, including: o Campaign committees o Party committees (national, state, and local) o Corporate and trade association PACs o Super PACs and Hybrid PACs o Non-committee 527 organizations o Leadership PACs o Joint fundraising committees o Presidential inaugural committees ● Our relationship officers assist political organizations with their banking needs, including: o Account opening and electronic document execution o Transaction account services o Payment processing o Comprehensive treasury management platform

11 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) Deposits from political organizations vary with the federal election cycle and are inherently seasonal. Historical trends may not predict future behavior. For related risks, see “Risk Factors” in our Annual Report on Form 10-K. Our Deposits Exhibit Seasonal Patterns, With Increases in the Quarters Leading Up To Federal Elections and Declines Afterwards1 Deposit Portfolio Seasonality ($ in billions) Quarter-end Immediately Preceding a Presidential or Midterm Election $0 .4 0 $0 .3 8 $0 .4 3 $0 .4 8 $0 .5 8 $0 .4 4 $0 .4 4 $0 .4 8 $0 .5 2 $0 .5 5 $0 .6 3 $0 .7 8 $0 .6 8 $0 .4 5 $0 .5 6 $0 .6 2 $0 .6 5 $0 .7 6 $0 .8 5 $0 .9 7 $1 .0 0 $0 .8 0 $0 .8 9 $0 .9 2 $1 .0 2 $1 .1 4 $1 .3 0 $1 .3 1 $1 .2 7 $0 .9 5 $0 .9 7 $1 .0 1 $1 .0 7 $1 .1 1 $1 .1 4 $1 .3 0 $1 .4 3 $1 .2 5 $1 .5 7 $1 .2 8 9/3 0/2 01 5 12 /31 /20 15 3/3 1/2 01 6 6/3 0/2 01 6 9/3 0/2 01 6 12 /31 /20 16 3/3 1/2 01 7 6/3 0/2 01 7 9/3 0/2 01 7 12 /31 /20 17 3/3 1/2 01 8 6/3 0/2 01 8 9/3 0/2 01 8 12 /31 /20 18 3/3 1/2 01 9 6/3 0/2 01 9 9/3 0/2 01 9 12 /31 /20 19 3/3 1/2 02 0 6/3 0/2 02 0 9/3 0/2 02 0 12 /31 /20 20 3/3 1/2 02 1 6/3 0/2 02 1 9/3 0/2 02 1 12 /31 /20 21 3/3 1/2 02 2 6/3 0/2 02 2 9/3 0/2 02 2 12 /31 /20 22 3/3 1/2 02 3 6/3 0/2 02 3 9/3 0/2 02 3 12 /31 /20 23 3/3 1/2 02 4 6/3 0/2 02 4 9/3 0/2 02 4 12 /31 /20 24 3/3 1/2 02 5 6/3 0/2 02 5 $— $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75

12 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) IntraFi Cash Services (ICS®) One-Way Sells are deposits placed with other member institutions within the IntraFi network; The Bank has the flexibility, subject to the terms and conditions of the IntraFi Participating Institution Agreement, to convert these One-Way Sells into reciprocal deposits which would then appear on the Bank's balance sheet. 2) Calculated as the sum of cash and cash equivalents plus unpledged investment grade securities, expressed as a percentage of total liabilities. Liquidity Ratio2 Primary Sources of Liquidity Liquidity Management 62.89% 78.75% 70.74% 78.75% 85.13% 88.21% 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 $ in millions As of June 30, 2025 Cash Reserves Held at the Federal Reserve Bank $ 364.8 ICS® One-Way Sell® Deposits1 121.2 Available for Sale Securities (At Fair Value) 469.3 Total Primary Sources of Liquidity $ 955.3

13 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) Includes loans held for sale. Asset Distribution Gross Loans1 / Deposits Balance Sheet Allocation 43.4% 24.9% 33.6% 27.4% 25.1% 22.5% 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 8.6% 10.2% 9.6% 26.3% 29.3% 26.1% 50.5% 65.0% 57.5% 47.0% 47.0% 52.5% 39.3% 23.3% 31.1% 25.2% 22.4% 19.9% 1.6% 1.5% 1.8% 1.5% 1.3% 1.5% Cash & Cash Equivalents Investment Grade Securities Gross Loans Other Assets 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 1

14 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) Available for sale securities are reported at fair value, and held to maturity securities are reported at amortized cost. Total securities is presented net of allowance. 2) Breakdown based on amortized cost for both available for sale securities and held to maturity securities. Securities Portfolio Overview Total Securities: $758.5M¹ Securities Portfolio Breakdown by Maturity Due Date2 Securities Composition as of June 30, 20251 31.6% 40.3% 7.4% 17.8% 42.2% 40.1% 32.0% 30.6% 57.2% 53.3% 40.0% 48.2% 29.2% 26.7% 33.2% 27.2% 16.4% 10.5%7.2% 2.4% 2.2% 1.7% 1.4% 1.2% One Year or Less After One Year through Five Years After Five Years through Ten Years After Ten Years 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 U.S. government treasuries, 56.2% U.S. federal agencies securities, 1.0% Mortgage backed securities, 1.0% Corporate bonds, 13.5% State and municipal securities, 28.3%

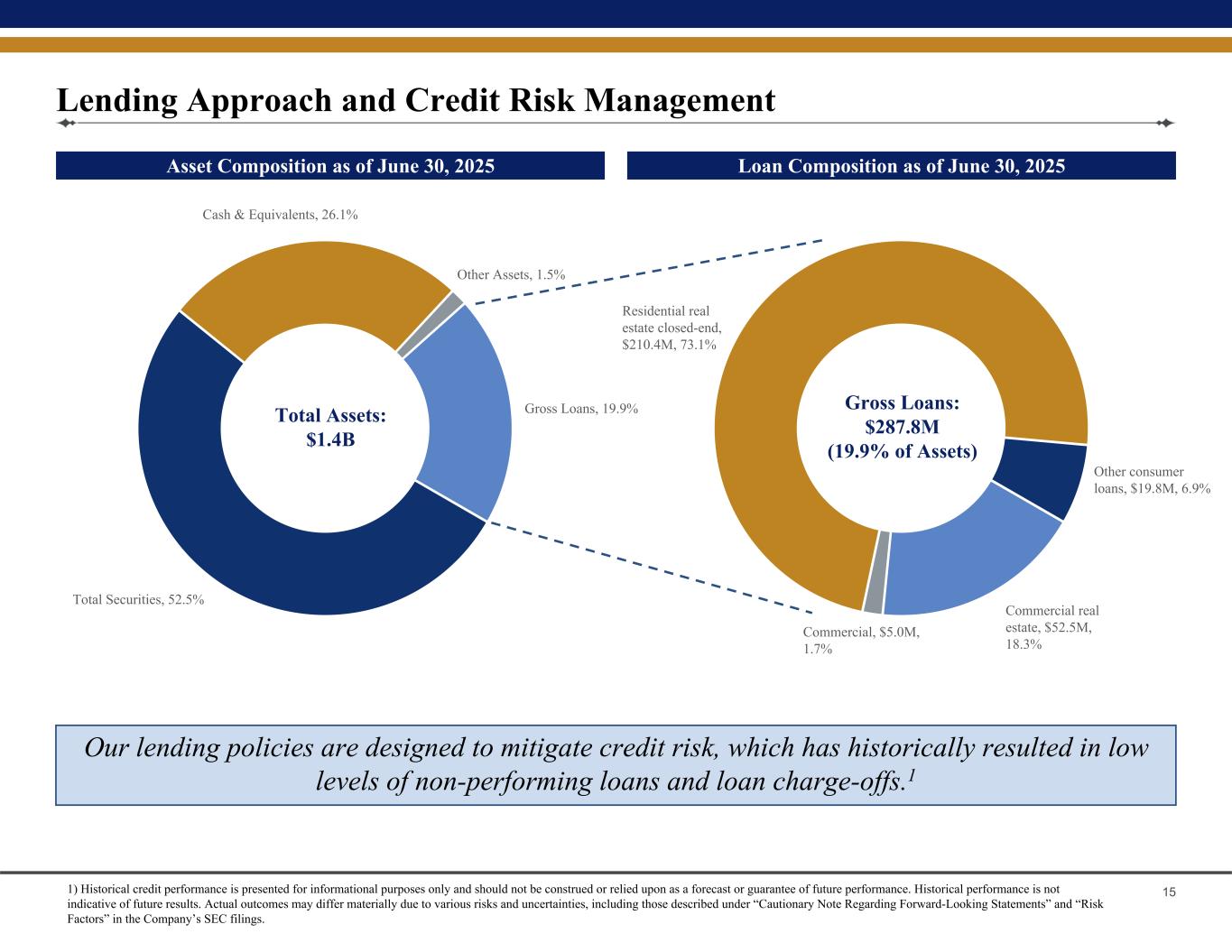

15 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Loan Composition as of June 30, 2025Asset Composition as of June 30, 2025 Lending Approach and Credit Risk Management Our lending policies are designed to mitigate credit risk, which has historically resulted in low levels of non-performing loans and loan charge-offs.1 Total Assets: $1.4B Gross Loans: $287.8M (19.9% of Assets) Total Securities, 52.5% Cash & Equivalents, 26.1% Other Assets, 1.5% Gross Loans, 19.9% Commercial real estate, $52.5M, 18.3% Commercial, $5.0M, 1.7% Residential real estate closed-end, $210.4M, 73.1% Other consumer loans, $19.8M, 6.9% 1) Historical credit performance is presented for informational purposes only and should not be construed or relied upon as a forecast or guarantee of future performance. Historical performance is not indicative of future results. Actual outcomes may differ materially due to various risks and uncertainties, including those described under “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s SEC filings.

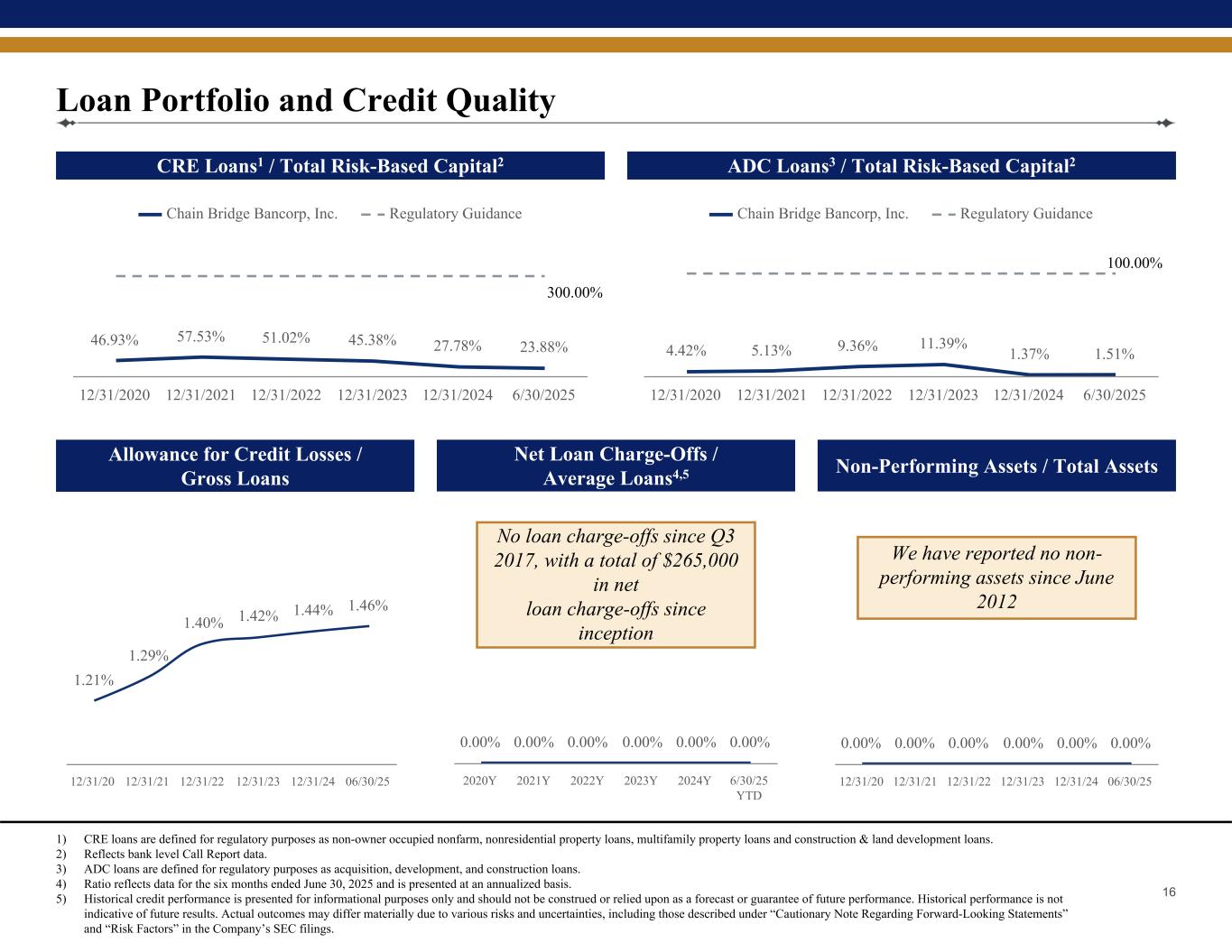

16 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) CRE loans are defined for regulatory purposes as non-owner occupied nonfarm, nonresidential property loans, multifamily property loans and construction & land development loans. 2) Reflects bank level Call Report data. 3) ADC loans are defined for regulatory purposes as acquisition, development, and construction loans. 4) Ratio reflects data for the six months ended June 30, 2025 and is presented at an annualized basis. 5) Historical credit performance is presented for informational purposes only and should not be construed or relied upon as a forecast or guarantee of future performance. Historical performance is not indicative of future results. Actual outcomes may differ materially due to various risks and uncertainties, including those described under “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s SEC filings. Net Loan Charge-Offs / Average Loans4,5 Allowance for Credit Losses / Gross Loans ADC Loans3 / Total Risk-Based Capital2CRE Loans1 / Total Risk-Based Capital2 Loan Portfolio and Credit Quality Non-Performing Assets / Total Assets No loan charge-offs since Q3 2017, with a total of $265,000 in net loan charge-offs since inception We have reported no non- performing assets since June 2012 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/25 YTD 1.21% 1.29% 1.40% 1.42% 1.44% 1.46% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 46.93% 57.53% 51.02% 45.38% 27.78% 23.88% Chain Bridge Bancorp, Inc. Regulatory Guidance 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 300.00% 4.42% 5.13% 9.36% 11.39% 1.37% 1.51% Chain Bridge Bancorp, Inc. Regulatory Guidance 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 100.00%

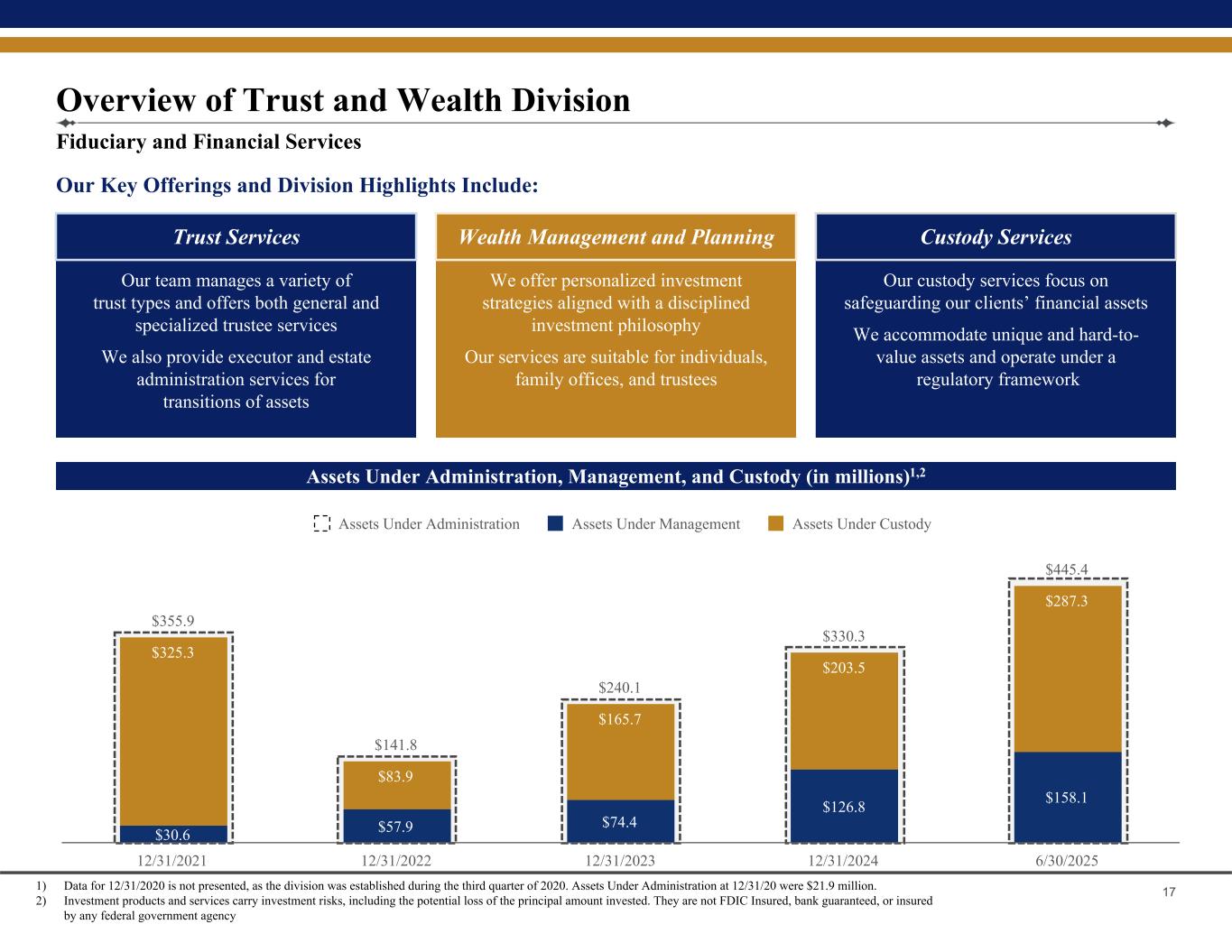

17 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Our Key Offerings and Division Highlights Include: Fiduciary and Financial Services Overview of Trust and Wealth Division Our team manages a variety of trust types and offers both general and specialized trustee services We also provide executor and estate administration services for transitions of assets Trust Services We offer personalized investment strategies aligned with a disciplined investment philosophy Our services are suitable for individuals, family offices, and trustees Wealth Management and Planning Our custody services focus on safeguarding our clients’ financial assets We accommodate unique and hard-to- value assets and operate under a regulatory framework Custody Services Assets Under Administration, Management, and Custody (in millions)1,2 $355.9 $141.8 $240.1 $330.3 $445.4 $30.6 $57.9 $74.4 $126.8 $158.1 $325.3 $83.9 $165.7 $203.5 $287.3 Assets Under Administration Assets Under Management Assets Under Custody 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 1) Data for 12/31/2020 is not presented, as the division was established during the third quarter of 2020. Assets Under Administration at 12/31/20 were $21.9 million. 2) Investment products and services carry investment risks, including the potential loss of the principal amount invested. They are not FDIC Insured, bank guaranteed, or insured by any federal government agency

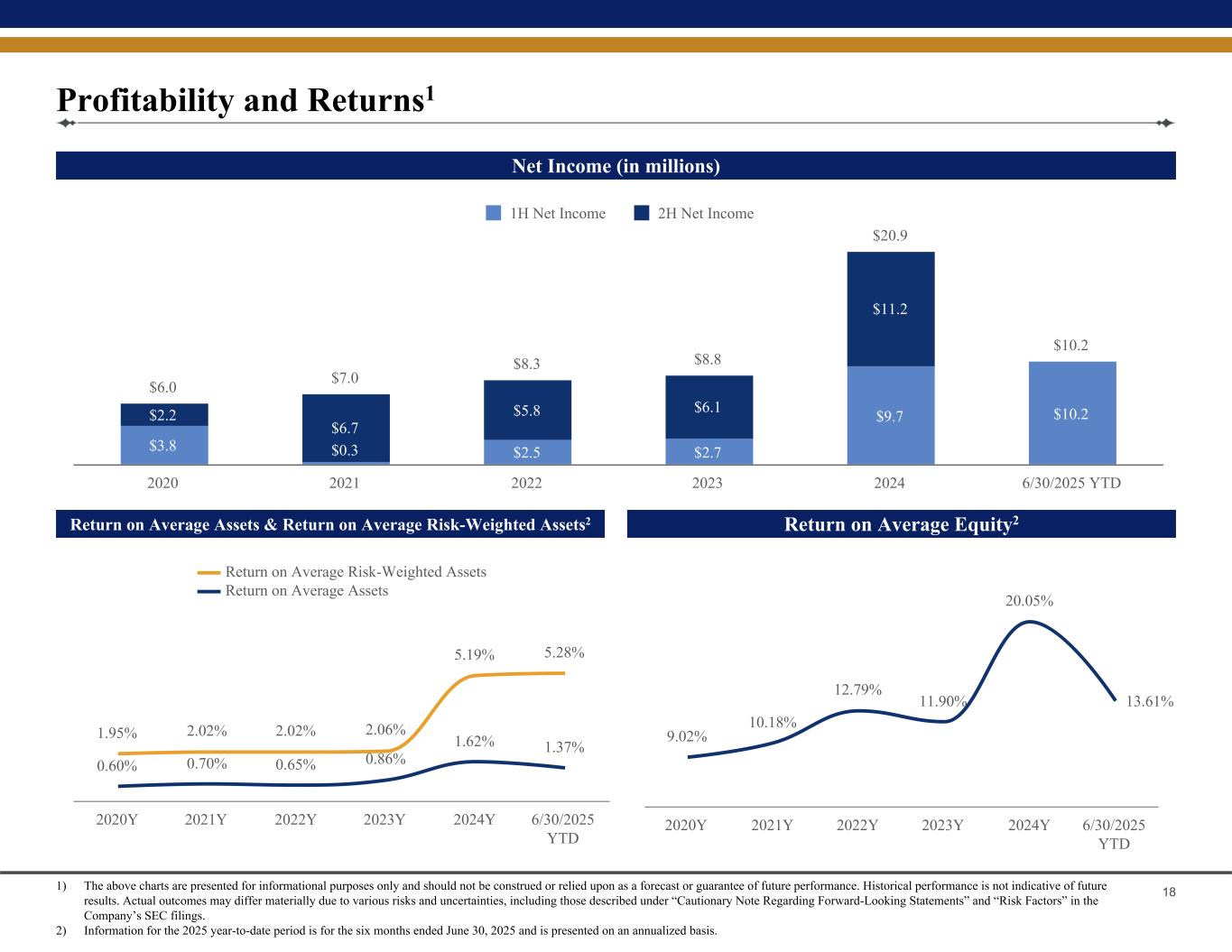

18 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) The above charts are presented for informational purposes only and should not be construed or relied upon as a forecast or guarantee of future performance. Historical performance is not indicative of future results. Actual outcomes may differ materially due to various risks and uncertainties, including those described under “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s SEC filings. 2) Information for the 2025 year-to-date period is for the six months ended June 30, 2025 and is presented on an annualized basis. Return on Average Equity2Return on Average Assets & Return on Average Risk-Weighted Assets2 Profitability and Returns1 Net Income (in millions) 0.60% 0.70% 0.65% 0.86% 1.62% 1.37% 1.95% 2.02% 2.02% 2.06% 5.19% 5.28% Return on Average Risk-Weighted Assets Return on Average Assets 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD 9.02% 10.18% 12.79% 11.90% 20.05% 13.61% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD $6.0 $7.0 $8.3 $8.8 $20.9 $10.2 $3.8 $0.3 $2.5 $2.7 $9.7 $10.2$2.2 $6.7 $5.8 $6.1 $11.2 1H Net Income 2H Net Income 2020 2021 2022 2023 2024 6/30/2025 YTD

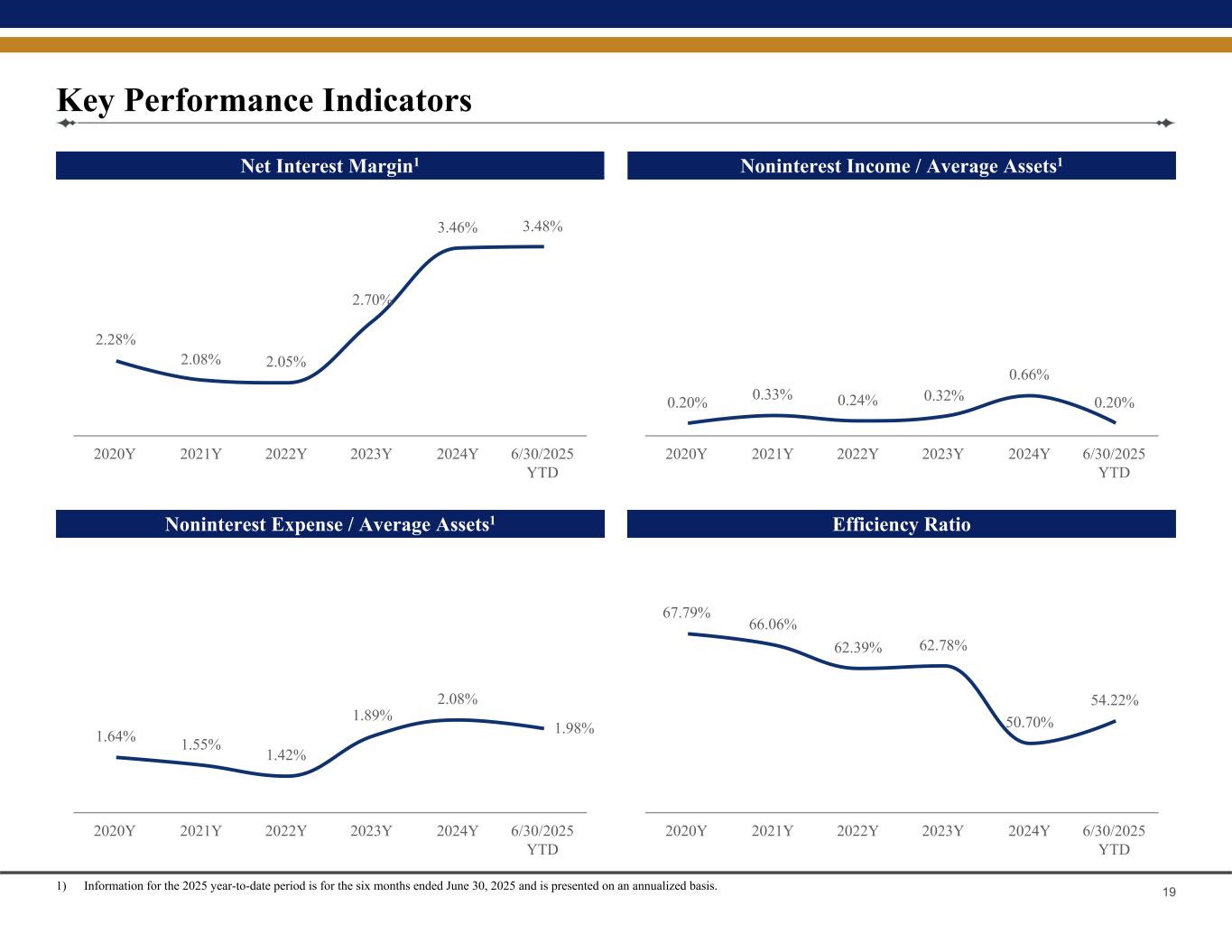

19 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) Information for the 2025 year-to-date period is for the six months ended June 30, 2025 and is presented on an annualized basis. Efficiency RatioNoninterest Expense / Average Assets1 Noninterest Income / Average Assets1Net Interest Margin1 Key Performance Indicators 2.28% 2.08% 2.05% 2.70% 3.46% 3.48% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD 67.79% 66.06% 62.39% 62.78% 50.70% 54.22% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD 0.20% 0.33% 0.24% 0.32% 0.66% 0.20% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD 1.64% 1.55% 1.42% 1.89% 2.08% 1.98% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD

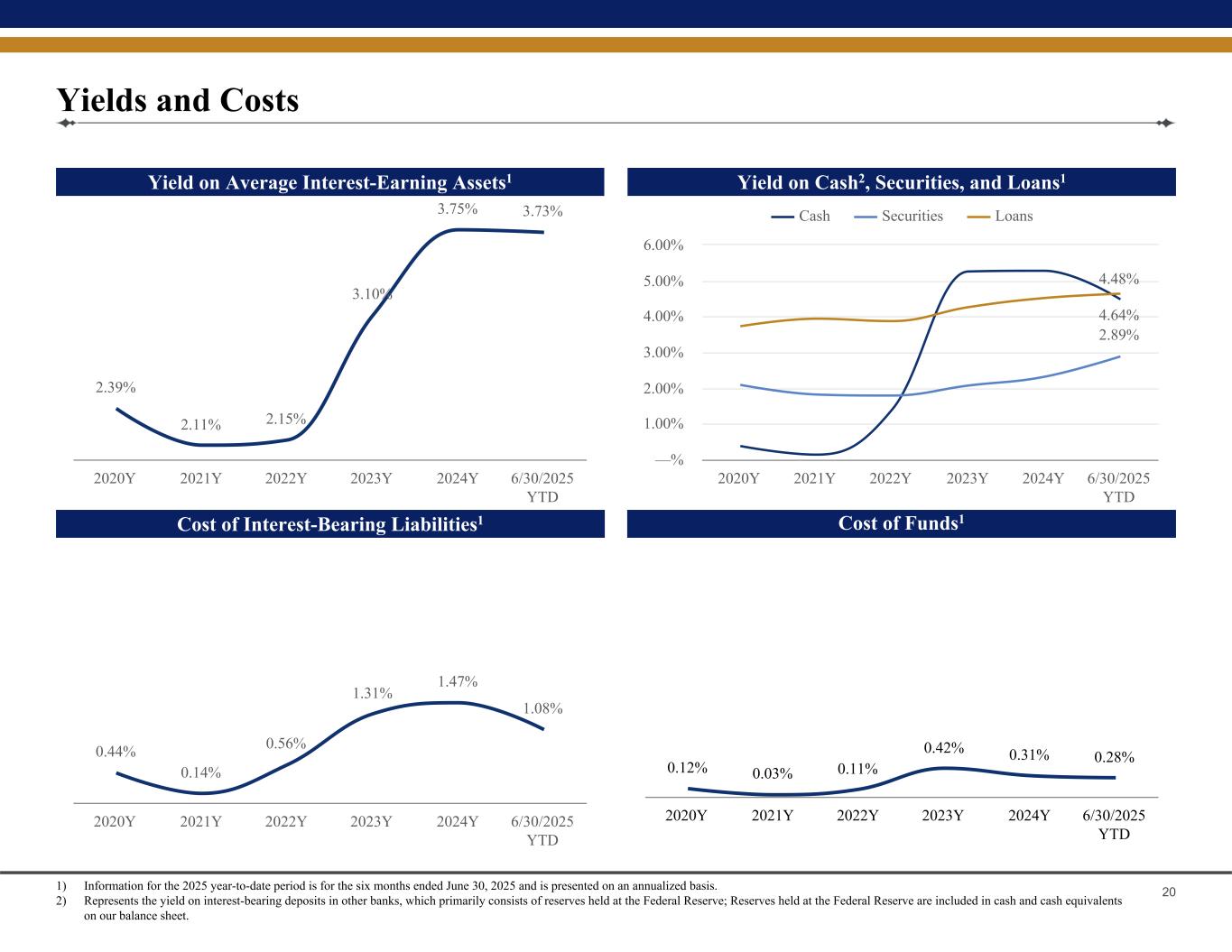

20 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) Information for the 2025 year-to-date period is for the six months ended June 30, 2025 and is presented on an annualized basis. 2) Represents the yield on interest-bearing deposits in other banks, which primarily consists of reserves held at the Federal Reserve; Reserves held at the Federal Reserve are included in cash and cash equivalents on our balance sheet. Yield on Cash2, Securities, and Loans1 Yields and Costs Cost of Funds1Cost of Interest-Bearing Liabilities1 0.12% 0.03% 0.11% 0.42% 0.31% 0.28% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD Yield on Average Interest-Earning Assets1 4.48% 2.89% 4.64% Cash Securities Loans 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD —% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2.39% 2.11% 2.15% 3.10% 3.75% 3.73% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD 0.44% 0.14% 0.56% 1.31% 1.47% 1.08% 2020Y 2021Y 2022Y 2023Y 2024Y 6/30/2025 YTD

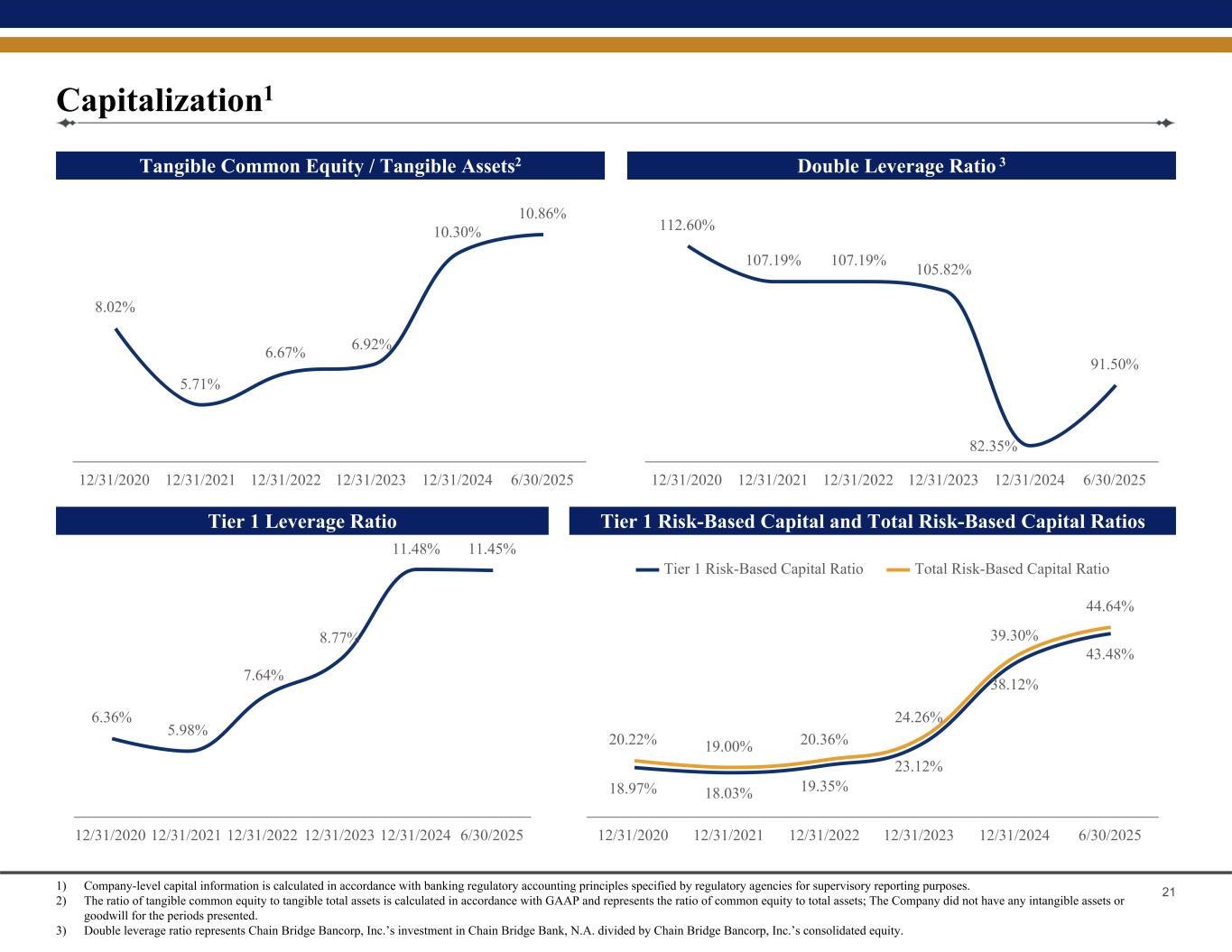

21 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins 1) Company-level capital information is calculated in accordance with banking regulatory accounting principles specified by regulatory agencies for supervisory reporting purposes. 2) The ratio of tangible common equity to tangible total assets is calculated in accordance with GAAP and represents the ratio of common equity to total assets; The Company did not have any intangible assets or goodwill for the periods presented. 3) Double leverage ratio represents Chain Bridge Bancorp, Inc.’s investment in Chain Bridge Bank, N.A. divided by Chain Bridge Bancorp, Inc.’s consolidated equity. Tier 1 Risk-Based Capital and Total Risk-Based Capital RatiosTier 1 Leverage Ratio Tangible Common Equity / Tangible Assets2 Capitalization1 Double Leverage Ratio 3 112.60% 107.19% 107.19% 105.82% 82.35% 91.50% 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 8.02% 5.71% 6.67% 6.92% 10.30% 10.86% 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 6.36% 5.98% 7.64% 8.77% 11.48% 11.45% 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 18.97% 18.03% 19.35% 23.12% 38.12% 43.48% 20.22% 19.00% 20.36% 24.26% 39.30% 44.64% Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025

22 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Where to Find More Information: • SEC Filings: www.sec.gov • Investor Relations Website: https://ir.chainbridgebank.com • Information Sourced from the Following Filings: ◦ Quarterly Report on Form 10-Q (Dated August 12, 2025, as of June 30, 2025) ◦ Earnings Release (Dated July 28, 2025, as of June 30, 2025) ◦ Annual Report to Security Holders on Form ARS (Dated April 29, 2025, as of December 31, 2024) ◦ Annual Report on Form 10-K (Dated March 21, 2025, as of December 31, 2024) ◦ Proxy Statement on Schedule 14A (Dated April 28, 2025, for Annual Meeting on June 18, 2025) ◦ Registration Statement on Form S-1, as Amended (Dated September 30, 2024) Investor Relations Contact: Hilary E. Albrecht Senior Vice President, Counsel and Corporate Secretary Chain Bridge Bancorp, Inc. IR@chainbridgebank.com 703-748-3427 Additional Information

23 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins I. Appendix

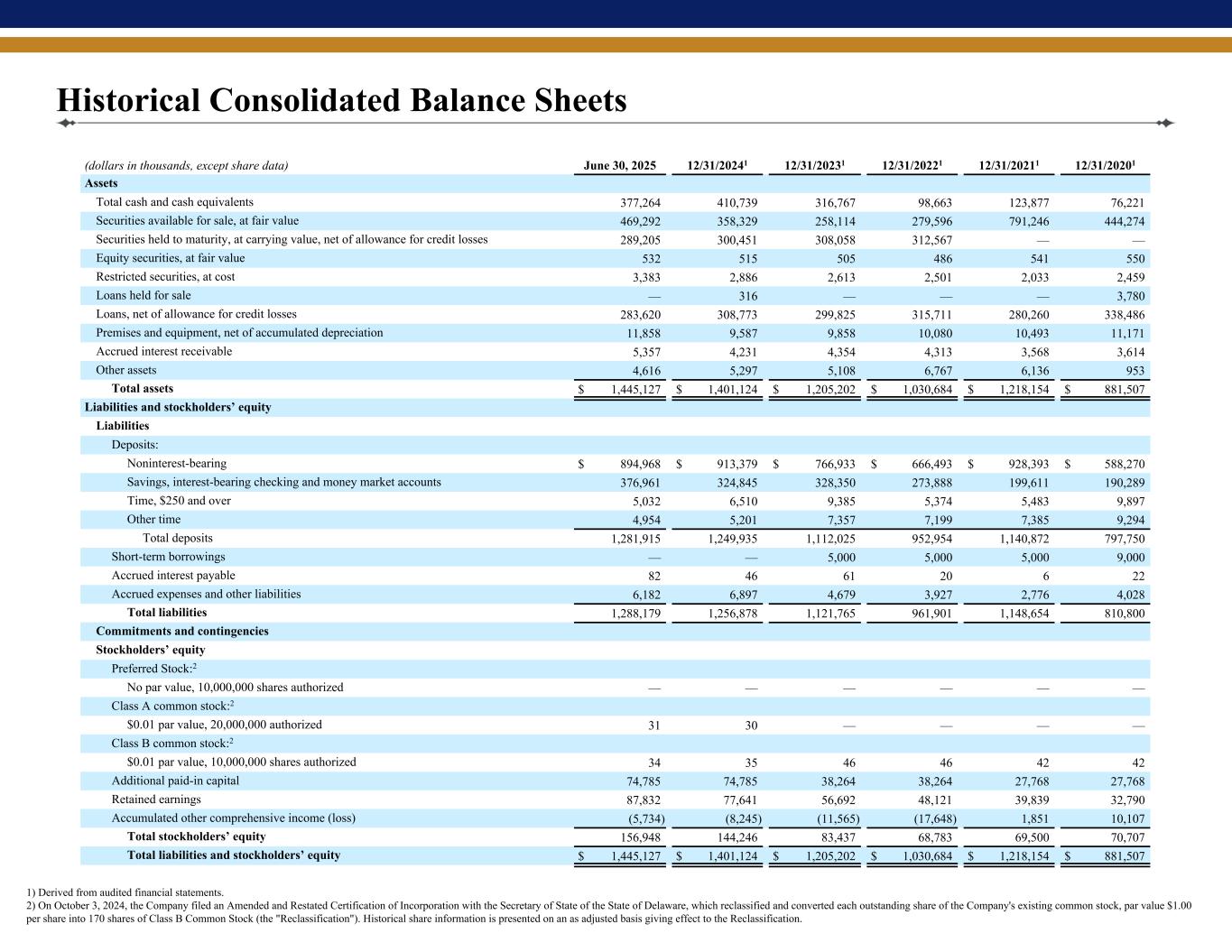

24 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Historical Consolidated Balance Sheets (dollars in thousands, except share data) June 30, 2025 12/31/20241 12/31/20231 12/31/20221 12/31/20211 12/31/20201 Assets Total cash and cash equivalents 377,264 410,739 316,767 98,663 123,877 76,221 Securities available for sale, at fair value 469,292 358,329 258,114 279,596 791,246 444,274 Securities held to maturity, at carrying value, net of allowance for credit losses 289,205 300,451 308,058 312,567 — — Equity securities, at fair value 532 515 505 486 541 550 Restricted securities, at cost 3,383 2,886 2,613 2,501 2,033 2,459 Loans held for sale — 316 — — — 3,780 Loans, net of allowance for credit losses 283,620 308,773 299,825 315,711 280,260 338,486 Premises and equipment, net of accumulated depreciation 11,858 9,587 9,858 10,080 10,493 11,171 Accrued interest receivable 5,357 4,231 4,354 4,313 3,568 3,614 Other assets 4,616 5,297 5,108 6,767 6,136 953 Total assets $ 1,445,127 $ 1,401,124 $ 1,205,202 $ 1,030,684 $ 1,218,154 $ 881,507 Liabilities and stockholders’ equity Liabilities Deposits: Noninterest-bearing $ 894,968 $ 913,379 $ 766,933 $ 666,493 $ 928,393 $ 588,270 Savings, interest-bearing checking and money market accounts 376,961 324,845 328,350 273,888 199,611 190,289 Time, $250 and over 5,032 6,510 9,385 5,374 5,483 9,897 Other time 4,954 5,201 7,357 7,199 7,385 9,294 Total deposits 1,281,915 1,249,935 1,112,025 952,954 1,140,872 797,750 Short-term borrowings — — 5,000 5,000 5,000 9,000 Accrued interest payable 82 46 61 20 6 22 Accrued expenses and other liabilities 6,182 6,897 4,679 3,927 2,776 4,028 Total liabilities 1,288,179 1,256,878 1,121,765 961,901 1,148,654 810,800 Commitments and contingencies Stockholders’ equity Preferred Stock:2 No par value, 10,000,000 shares authorized — — — — — — Class A common stock:2 $0.01 par value, 20,000,000 authorized 31 30 — — — — Class B common stock:2 $0.01 par value, 10,000,000 shares authorized 34 35 46 46 42 42 Additional paid-in capital 74,785 74,785 38,264 38,264 27,768 27,768 Retained earnings 87,832 77,641 56,692 48,121 39,839 32,790 Accumulated other comprehensive income (loss) (5,734) (8,245) (11,565) (17,648) 1,851 10,107 Total stockholders’ equity 156,948 144,246 83,437 68,783 69,500 70,707 Total liabilities and stockholders’ equity $ 1,445,127 $ 1,401,124 $ 1,205,202 $ 1,030,684 $ 1,218,154 $ 881,507 1) Derived from audited financial statements. 2) On October 3, 2024, the Company filed an Amended and Restated Certification of Incorporation with the Secretary of State of the State of Delaware, which reclassified and converted each outstanding share of the Company's existing common stock, par value $1.00 per share into 170 shares of Class B Common Stock (the "Reclassification"). Historical share information is presented on an as adjusted basis giving effect to the Reclassification.

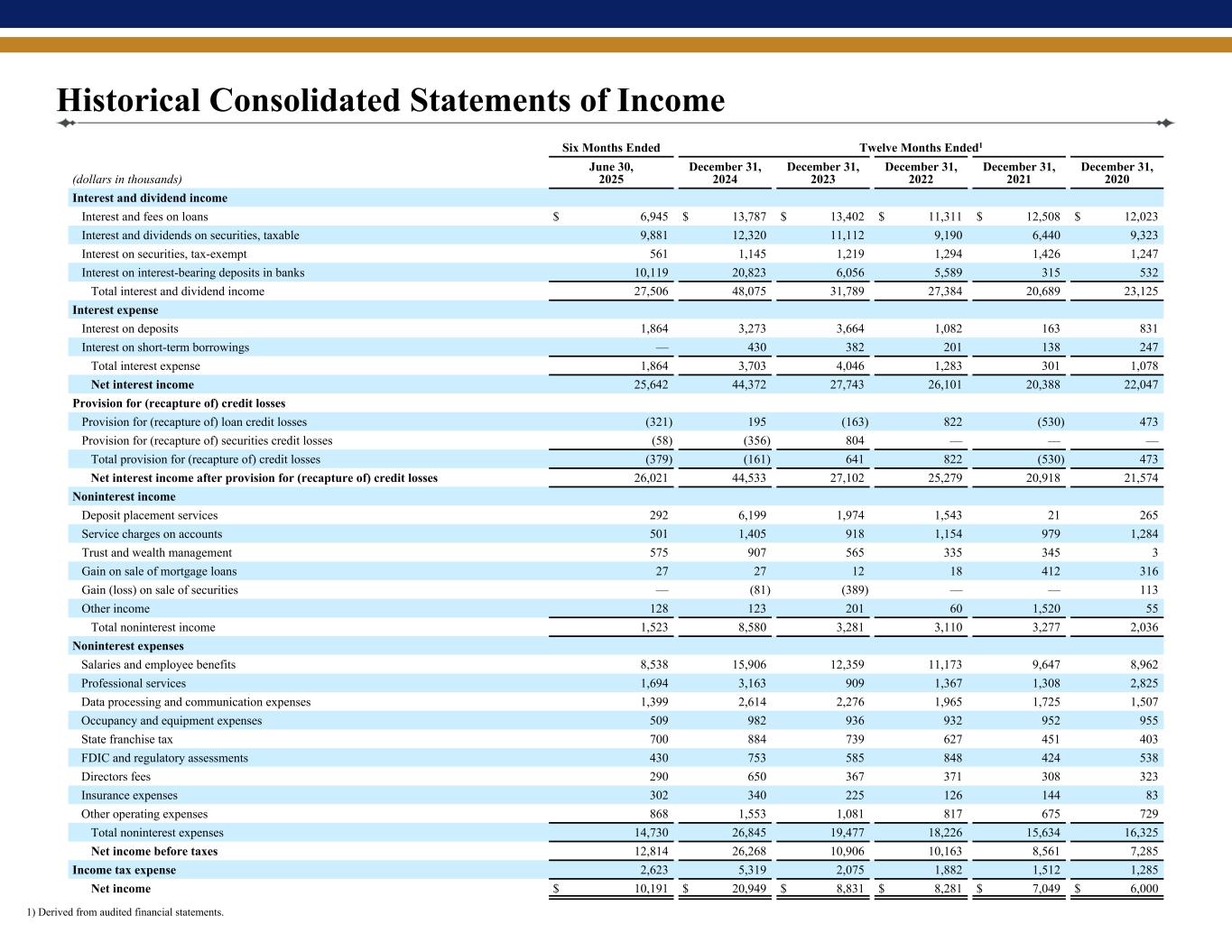

25 68 72 74 15 49 109 42 80 130 232 159 44 148 109 51 233 234 235 100 100 100 Binding Zone Printer Margins Historical Consolidated Statements of Income Six Months Ended Twelve Months Ended1 (dollars in thousands) June 30, 2025 December 31, 2024 December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Interest and dividend income Interest and fees on loans $ 6,945 $ 13,787 $ 13,402 $ 11,311 $ 12,508 $ 12,023 Interest and dividends on securities, taxable 9,881 12,320 11,112 9,190 6,440 9,323 Interest on securities, tax-exempt 561 1,145 1,219 1,294 1,426 1,247 Interest on interest-bearing deposits in banks 10,119 20,823 6,056 5,589 315 532 Total interest and dividend income 27,506 48,075 31,789 27,384 20,689 23,125 Interest expense Interest on deposits 1,864 3,273 3,664 1,082 163 831 Interest on short-term borrowings — 430 382 201 138 247 Total interest expense 1,864 3,703 4,046 1,283 301 1,078 Net interest income 25,642 44,372 27,743 26,101 20,388 22,047 Provision for (recapture of) credit losses Provision for (recapture of) loan credit losses (321) 195 (163) 822 (530) 473 Provision for (recapture of) securities credit losses (58) (356) 804 — — — Total provision for (recapture of) credit losses (379) (161) 641 822 (530) 473 Net interest income after provision for (recapture of) credit losses 26,021 44,533 27,102 25,279 20,918 21,574 Noninterest income Deposit placement services 292 6,199 1,974 1,543 21 265 Service charges on accounts 501 1,405 918 1,154 979 1,284 Trust and wealth management 575 907 565 335 345 3 Gain on sale of mortgage loans 27 27 12 18 412 316 Gain (loss) on sale of securities — (81) (389) — — 113 Other income 128 123 201 60 1,520 55 Total noninterest income 1,523 8,580 3,281 3,110 3,277 2,036 Noninterest expenses Salaries and employee benefits 8,538 15,906 12,359 11,173 9,647 8,962 Professional services 1,694 3,163 909 1,367 1,308 2,825 Data processing and communication expenses 1,399 2,614 2,276 1,965 1,725 1,507 Occupancy and equipment expenses 509 982 936 932 952 955 State franchise tax 700 884 739 627 451 403 FDIC and regulatory assessments 430 753 585 848 424 538 Directors fees 290 650 367 371 308 323 Insurance expenses 302 340 225 126 144 83 Other operating expenses 868 1,553 1,081 817 675 729 Total noninterest expenses 14,730 26,845 19,477 18,226 15,634 16,325 Net income before taxes 12,814 26,268 10,906 10,163 8,561 7,285 Income tax expense 2,623 5,319 2,075 1,882 1,512 1,285 Net income $ 10,191 $ 20,949 $ 8,831 $ 8,281 $ 7,049 $ 6,000 1) Derived from audited financial statements.